Are you missing out on important benefits?

Thousands of people in the UK are losing out by not claiming the benefits they’re entitled to. Could you be one of them?

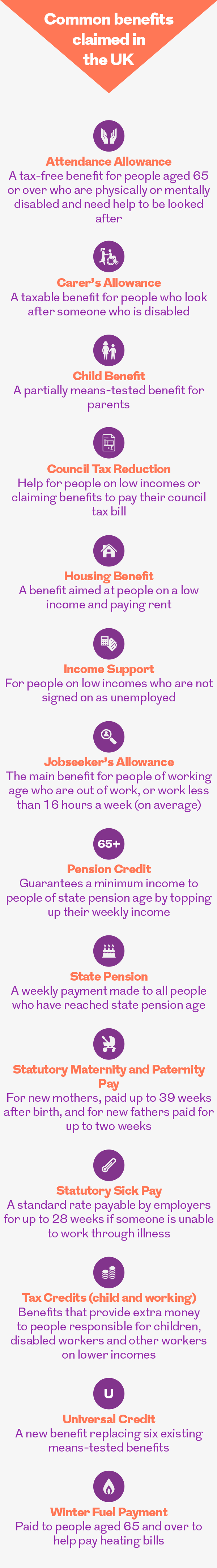

Whether you’re young or old, working, unemployed or retired, a parent or carer, unwell or disabled, a homeowner or tenant, married or widowed, you could be eligible for benefits and tax credits that could help to improve your standard of living, health and financial wellbeing.

Yet recent research shows that many people in the UK are missing out on valuable state benefits. Earlier this year, Royal London discovered that 3,524 out of an estimated 160,000 eligible carers claimed National Insurance credit in 2016/17. This means only 3% of carers are benefiting from a scheme that’s designed to help them build up their right to a better state pension.

While this is an extreme example, it’s not unique. Research from the Resolution Foundation found that 300,000 unemployed or low earning people are missing out on state financial support worth at least £73 a week.

And, according to data from the Department for Work and Pensions, up to £12.4bn of means-tested benefits (where the amount of income and savings you have can affect your eligibility) were left unclaimed in 2015/16. This amount included pension credit, housing benefit, jobseekers and employment support allowance.

How to take action

It can be tricky working out whether or not you’re entitled to any benefits. Some are means-tested, while others, such as Statutory Sick Pay, aren’t. To make things more complicated, the system’s changing with the gradual introduction of Universal Credit, which will replace six means-tested benefits.

Both Royal London and the Resolution Foundation have called for the Government to do more to boost take-up of benefits by people who need financial support. You can also take action by checking you’re not missing out on any benefits you could qualify for.

There are several online calculators that can help identify your eligibility for income-related benefits, Tax Credits, Council Tax Reduction, Carer’s Allowance and Universal Credit. These include:

Age UK also has a benefits calculator, and can help with age-related benefits such as Winter Fuel Payment, free TV licenses and bus passes, and the Pension Credit. Their website includes useful information on how to claim each type of benefit, and staff at local Age UK branches can also answer questions and help people fill in forms.

If you prefer talking to someone, either face-to-face or on the phone, Citizens Advice can help you work out what benefits you might be eligible for, and give you information about how to claim them. Visit their website for more information on how to book an appointment and where to find your nearest branch.

More for you

Where does your tax go?

We all know we have to pay taxes, but do you know how they’re spent? Test your knowledge with our tax challenge

MORE

Our People Promise

Some of our colleagues explain how the ‘People Promise’ helps them to deliver the best experiences and outcomes for customers and members

MORE

Royal London Foundation: Proud & Loud Arts

Your nominations for the Royal London Foundation help organisations like Proud & Loud Arts, a user-led performing arts charity, to keep doing great work in your local communities

MORE