Helping your grandchildren financially

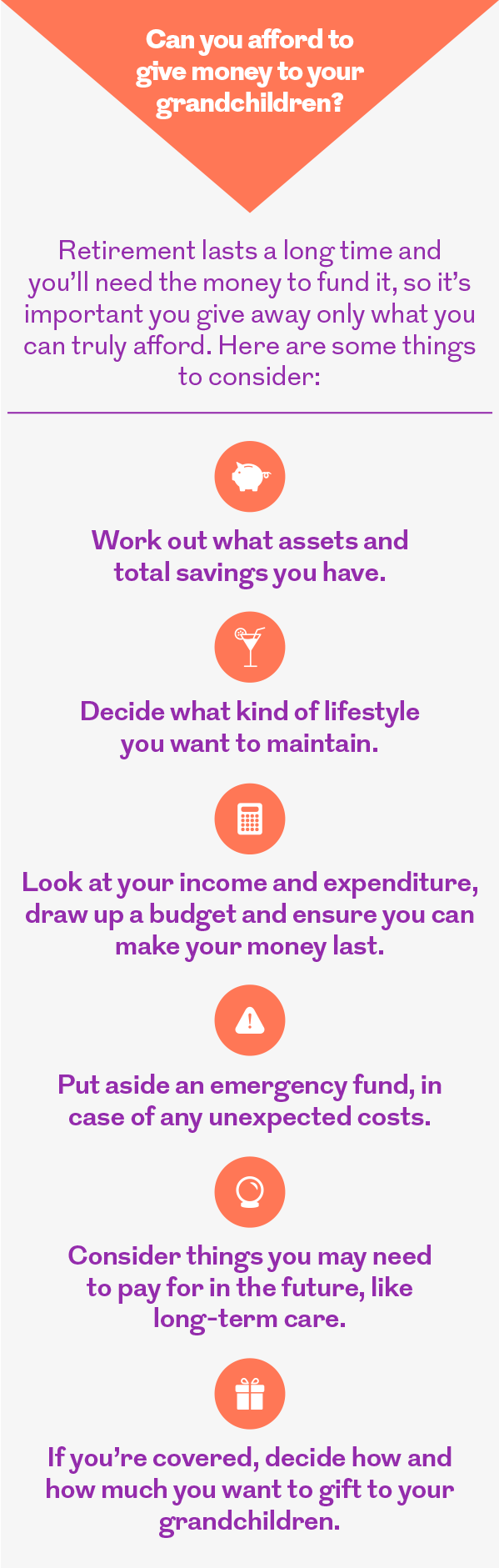

If you can afford to help out, there are a number of ways you can give money to your grandchildren

Rising house prices, poor wage growth and the increasing cost of education means the younger generation is facing an uphill battle when it comes to their finances. While research from the Resolution Foundation shows that millennials are set to receive more money from relatives than ever before, the bad news is they’ll be 61, on average, before they inherit it.

Financial help from grandparents can make a real difference to younger people’s lives, especially if they’re struggling to save money or get by. So, if you can afford it, what are the options when it comes to helping your grandchildren?

Putting money in a Junior ISA

If your grandchildren are under 18, then you could put money into a Junior ISA (JISA) on their behalf. Under the 2018–19 tax year rules, up to £4,260 can be put into a JISA each year, and there’s no tax payable on the earnings – the savings limit for JISAs can change from year to year, however, so it’s worth checking it online. Your grandchildren will be able to access the account once they turn 18.

Another benefit of a JISA is that when it matures, it automatically converts to an adult ISA, and the balance doesn’t count towards your grandchild’s ISA allowance.

Only a parent or legal guardian can open a JISA, so you’ll need to speak to your children to see if they have set up JISAs for your grandchildren that you can contribute to. It’s also important to be aware that the money you put in a JISA may be liable for inheritance tax (IHT) if you die within seven years of making the gift.

Buying Premium Bonds

Another tax efficient option is Premium Bonds. Prizes are tax-free and the money is 100% secured, as National Savings and Investment (NS&I) is backed by the Treasury. The drawback is your money won’t earn interest – the only returns come from the monthly prize draw, and you can win between £25 and £1m.

Grandparents can buy Premium Bonds on behalf of their grandchildren. You can apply online or by post, and buy bonds in £100 increments (falling to £25 in 2019).

Opening a pension

If you want to think more long-term, there’s nothing to stop you setting up a pension for your grandchild. Children are allowed to have a pension, and anyone can contribute. The maximum you can put in a year is £2,880, and that will benefit from a 20% top up from the government.

The appeal of a pension is that the money has decades to grow. By the time your grandchildren can access the money – in their mid-50s – it should have grown into a substantial nest egg to help them in later life. The drawback is they can’t use the money when they may need it most, to buy a house or fund their education.

Giving a financial gift

The simplest way to help out the younger generation is with a financial gift. You just need to be aware of the rules surrounding IHT.

You can give away up to £3,000 a year and it’s IHT exempt. You can also gift unlimited amounts up to £250 – provided it isn’t going to someone who has already benefitted from the £3,000 gifts. Furthermore, you can also give a grandchild £2,500 the year they get married (parents can give £5,000).

Gifts beyond this will still count as part of your estate if you die within seven years, so could be liable for IHT. If you want to gift cash to minimise your IHT bill, it’s a good idea to speak to an independent financial adviser.

Setting up a trust

If you’re expecting your estate to face a hefty IHT bill, then another option is to set up a trust. A ‘discretionary trust’ allows you to gift money to your grandchildren, with trustees (perhaps their parents) in charge of managing the assets and distributing them.

The money stops being part of your estate when you pay it into the trust, so it can help with IHT planning. But certain conditions have to be met and the rules around trusts can be quite complex, so it’s worth seeking professional financial advice before setting one up.

More for you

Your Q4 2018 outlook

Trevor Greetham, Head of Multi Asset Investments at Royal London, explains how global politics, rising inflation and interest rates could impact your money in Q4 2018

MORE

Mothers missing out on millions

Royal London's Steve Webb, Director of Policy, and Becky O'Connor, Personal Finance Specialist, explain how a change in the child benefit system is causing thousands of mothers to end up with a reduced state pension

MORE

Helping the organisations that matter to you

Your nominations helped us donate £350,000 to not-for-profit organisations across the UK in 2018

MORE