How does inflation affect your money?

If you don’t plan effectively, inflation could cause your pot of hard-earned cash to shrink

Understanding inflation is an important factor when it comes to financial success. If you don’t factor inflation in when deciding where to put your money – whether that’s savings accounts or investing – you could find your pot shrinks over the years.

Figures from the Consumer Price Index show that, at the time of writing in October 2017, inflation was at 3% – the highest it has been for five years. This means the prices of key goods that households need to buy, such as food, fuel and clothing, are rising at a rate of 3% a year.

If your savings aren’t earning at least 3% a year, the effect of inflation will mean your money will buy less in a year’s time. For example, if you put £100 into a bank account paying 1% interest, you would have £101 after 12 months. But, 3% inflation will mean that the things that cost you £100 when you put your money in your account will cost you £103 a year later – so your money has lost purchasing power.

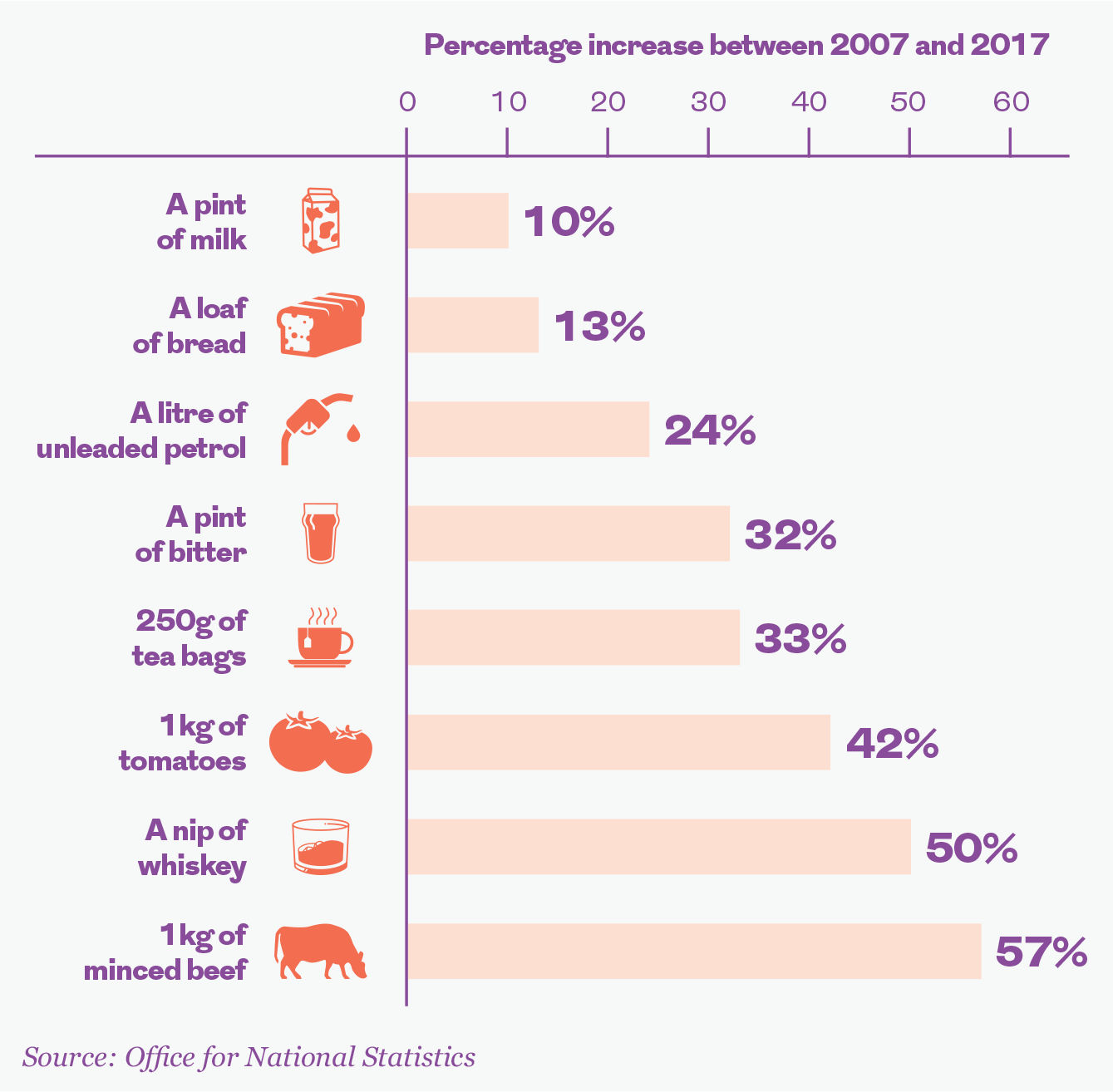

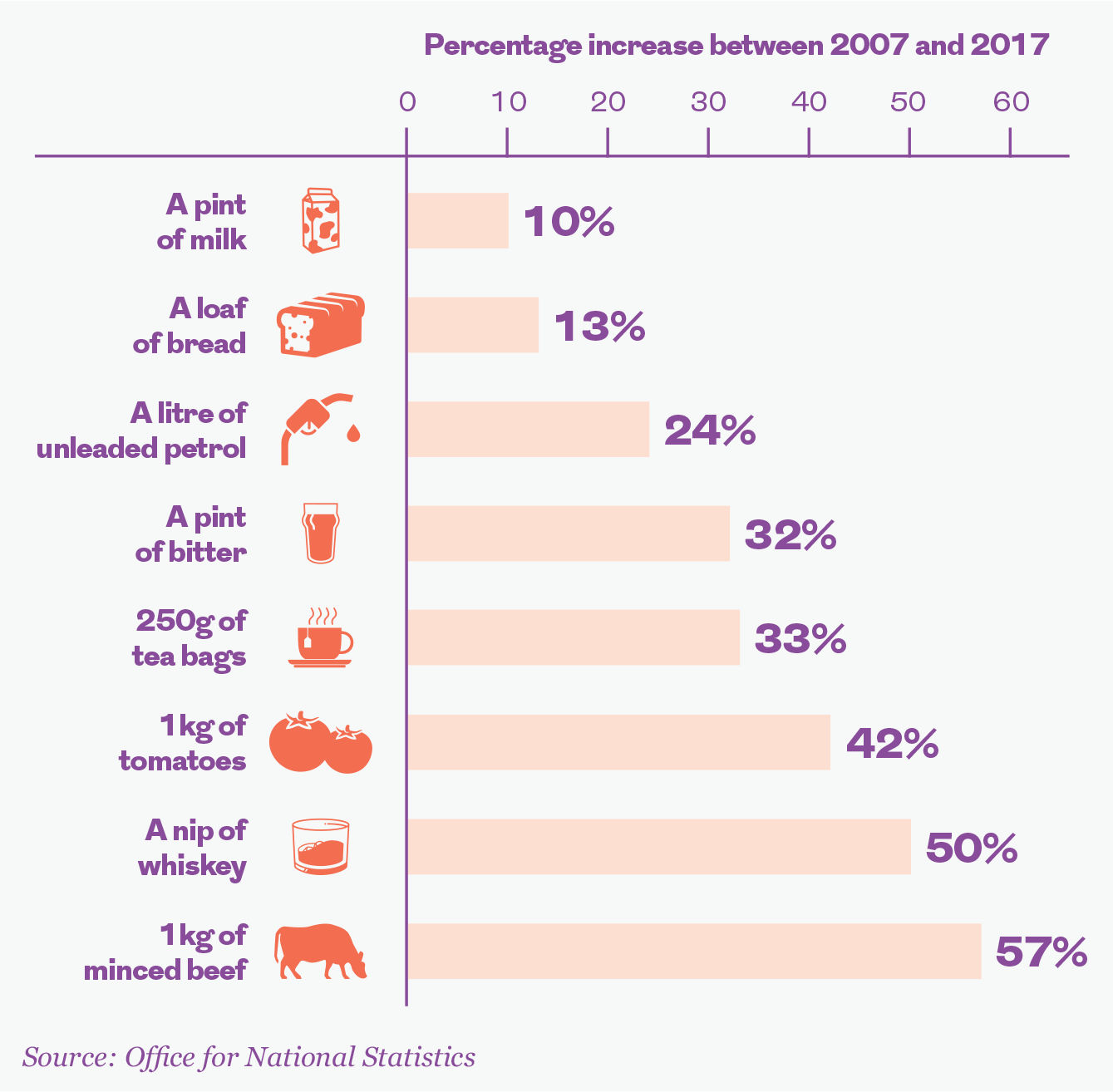

A lengthy period of inflation means many household staples cost considerably more now than they did 10 years ago, meaning your money has to work a lot harder to buy the same things.

The cost of some foods, for example, has rocketed. A kilogram of minced beef would have cost you an average of £4.75 back in Autumn 2007, but the price has risen by 57% since then to £7.44.

The way to avoid this problem should be simple: place your money in savings accounts paying more than 3% interest. But, unfortunately, accounts paying that level of interest are few and far between. In fact, there isn’t a single traditional savings account that pays more than 3% interest. In October 2017, the best you could do was a 2.55% return, and customers would have to lock their money away for seven years to get that rate.

Plus, if you pay tax on your savings interest, then you need an even higher rate of interest to leave your money growing faster than inflation. You can’t even rely on a cash ISA to help you out – the best rate available at the time of writing was just 2.4% on a five-year fixed-rate ISA.

So, what can you do?

The good news is that it is possible to get an inflation-beating return on your savings, as there are plenty of investment opportunities. But, this involves taking on a little more risk than a cash savings account.

The FTSE 100 has delivered average growth of 9.1% a year over the past five years, so even putting your money into a FTSE tracker could help you beat inflation. Another option might be to invest in bonds – traditionally government bonds are seen as a very low-risk investment, but returns here have plummeted as people have raced to invest in these safe-haven investments.

Investing can be particularly helpful if you are wanting to save money for the long term. Inflation can really take a bite out of your returns over long periods, so you need to make sure your money grows faster than the prices of goods you’ll want to buy with it.

If you want to increase your returns so that your savings grow faster than inflation, then investing is a good way to do it. But, you are taking on more risk than if you stuck with cash. There are many ways you can mitigate this from choosing low-risk investments to spreading your cash across a number of asset classes and geographic regions.

Seeking impartial financial advice can help you to build a portfolio that aims to achieve the returns you want, while also reflecting your attitude to risk.

Price changes for common commodities from 2007 to 2017

More for you

ProfitShare

We give your savings pot an extra boost by adding a share of our profits to your plan every year

MORE

What happens when you invest with us?

Piers Hillier, Chief Investment Officer at Royal London, explains how we invest With Profits members' money to get you the best possible returns

MORE

Insight into Work: come and work with us!

Our Insight into Work programme means members and their families can experience work at Royal London. Five of our newest candidates tell us about their time working with us

MORE