How to prepare for sending your children to university

As costs are higher than ever, it’s important to take whatever steps you can to plan ahead for your child starting university

With headlines about university tuition fees and the high cost of living for students staying away from home, paying for higher education can seem daunting. But there’s no need to be put off, and there are many things you can do to prepare and reduce the cost of continued study.

Comparing tuition fees

Tuition fees are set by the university and not all charge the higher amount of £9,250 per year. It’s worth comparing what different universities charge to see if savings can be made. You can find out more about university tuition fees here. It’s also important to remember that different rules apply in Scotland.

Paying for accommodation and living expenses

One of the biggest expenses for would-be students is accommodation costs and living expenses, so it’s a good idea to shop around for the best option. For example, if your child is attending university close to home, then it might be worth them staying at the family home and travelling into university. It could also be worth comparing the costs of university flats or halls of residence with other rental accommodation nearby. Remember that many university halls of residence may also provide residents with meals, which could work out cheaper in the long run.

Checking for grants and bursaries

Students in higher education can apply to their university for various grants and bursaries. Each university will operate their own rules about who gets what, but it’s worth checking with student support services to see what’s available. Unlike student loans, these grants and bursaries don’t have to be paid back.

Applying for student finance

While tuition fees are extremely expensive, this money doesn’t have to be paid up front and student finance is available. These loans are split into tuition fee loans and maintenance cost loans, but current rules mean that your graduate son or daughter will not have to start repaying the debt until they earn more than £25,000.

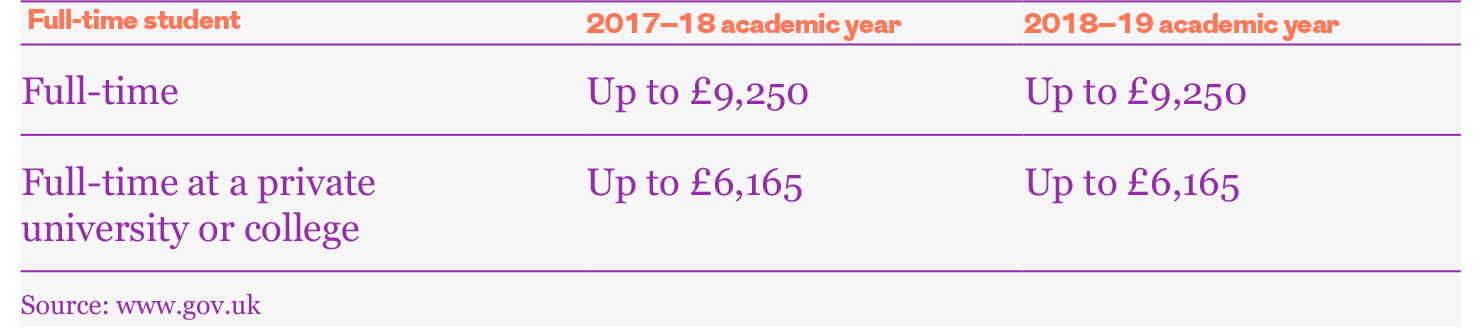

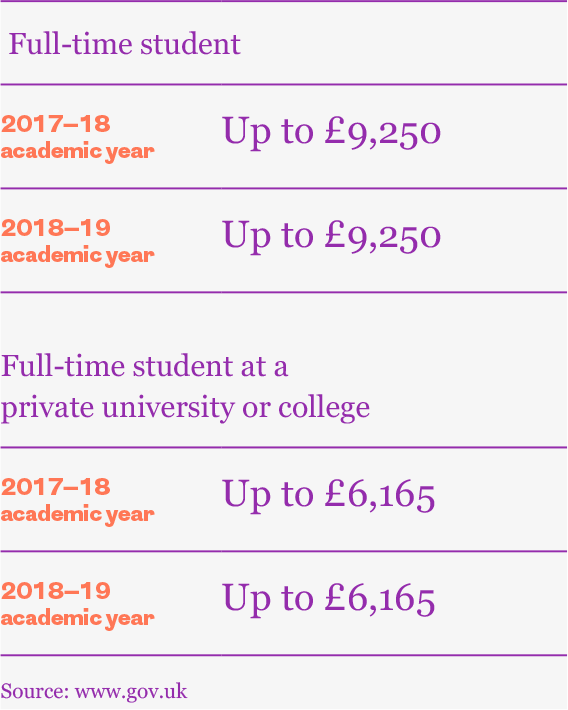

Tuition fee loans are available up to the amounts listed below.

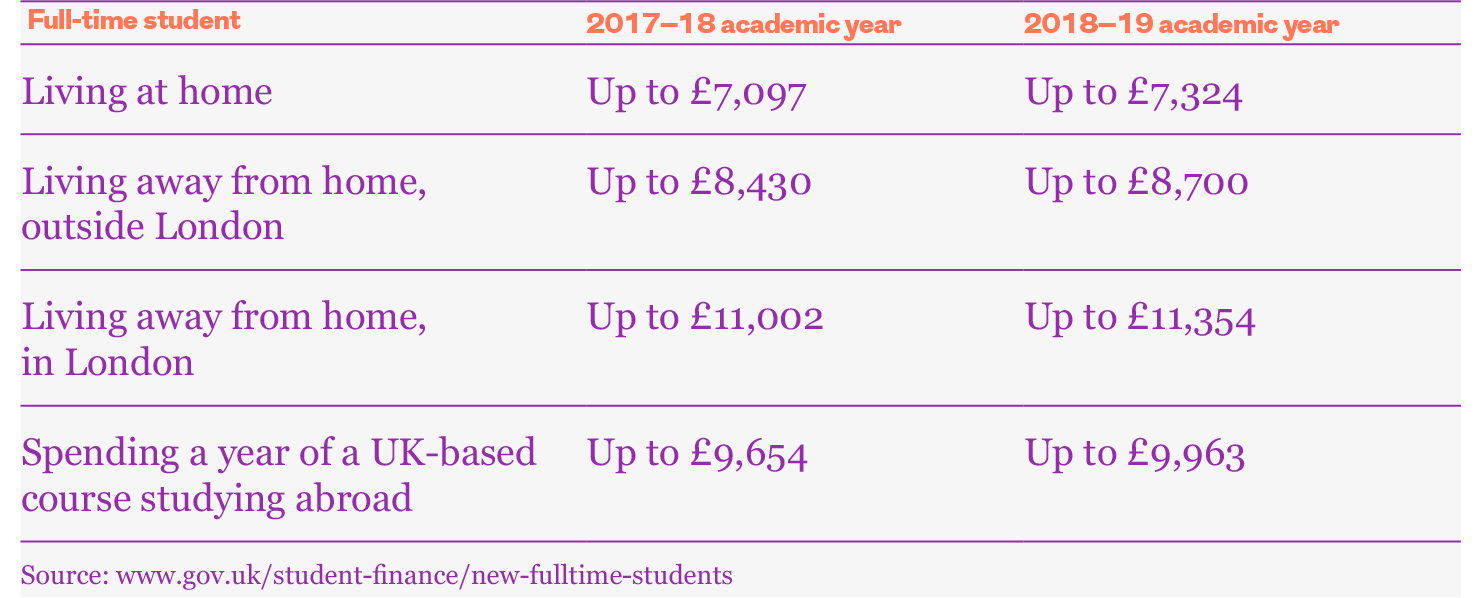

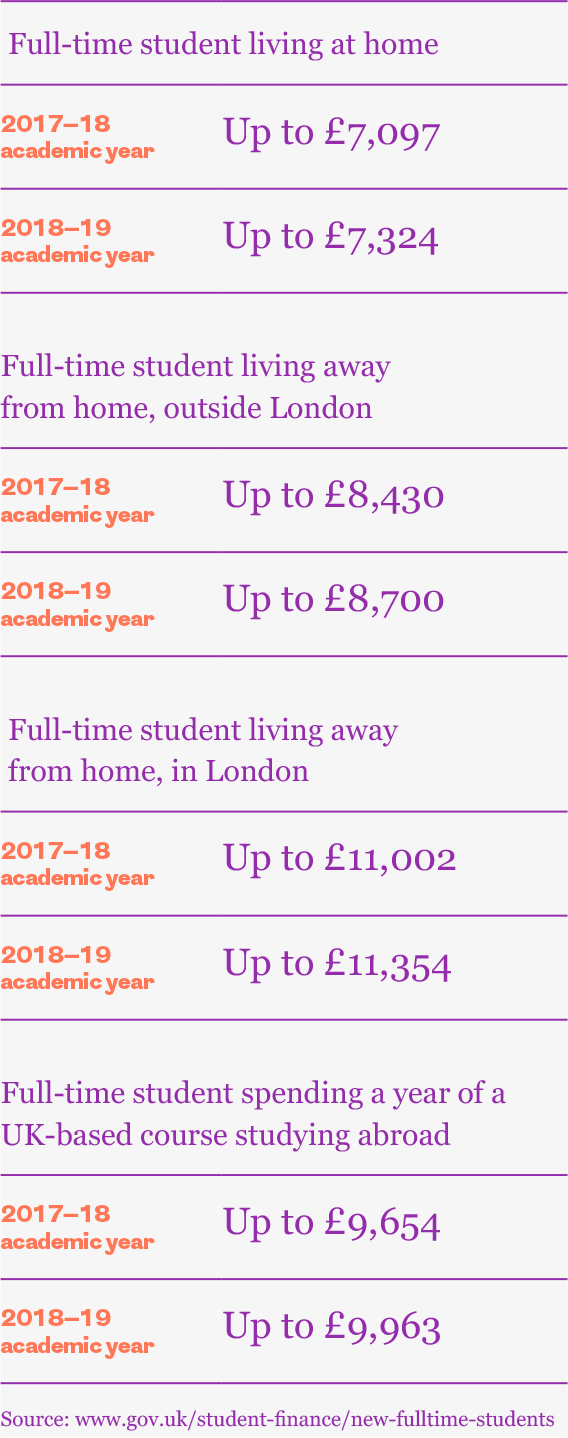

To get a maintenance loan, you’re likely to need to give details of your household income. The loan is then paid into the student’s bank account at the beginning of each term and it will need to be repaid. You can find out more about loan repayments here. The maximum loan amounts available, as listed on gov.uk, are shown below, but much lower amounts apply when children have parents with higher incomes.

Helping them get the best student bank account

The student bank account market is fiercely competitive, offering all kinds of freebies such as vouchers and Amazon Prime subscriptions. It’s worth spending time with your child going through the options, and pointing them in the right direction. Interest-free overdrafts can save your son or daughter lots of money in the long run, as can student railcards.

Preparing a budget for you and for them

Going to university might be the first time your son or daughter has had to manage their money themselves, so it may be helpful to sit down with them to work out a budget. If you’re contributing to their living expenses, for instance, you could outline how much you’ll give them, add up how much they’ll be getting each term in terms of loans and income (from student jobs, for example), and work out how much they can afford to spend each month.

More for you

Helping the organisations that matter to you

Your nominations helped us donate £350,000 to not-for-profit organisations across the UK in 2018

MORE

Creating more work experience opportunities for members

Our Insight into Work programme has helped lots of members and their families, and we’ve got more opportunities in store for you

MORE

Your Q4 2018 outlook

Trevor Greetham, Head of Multi Asset Investments at Royal London, explains how global politics, rising inflation and interest rates could impact your money in Q4 2018

MORE