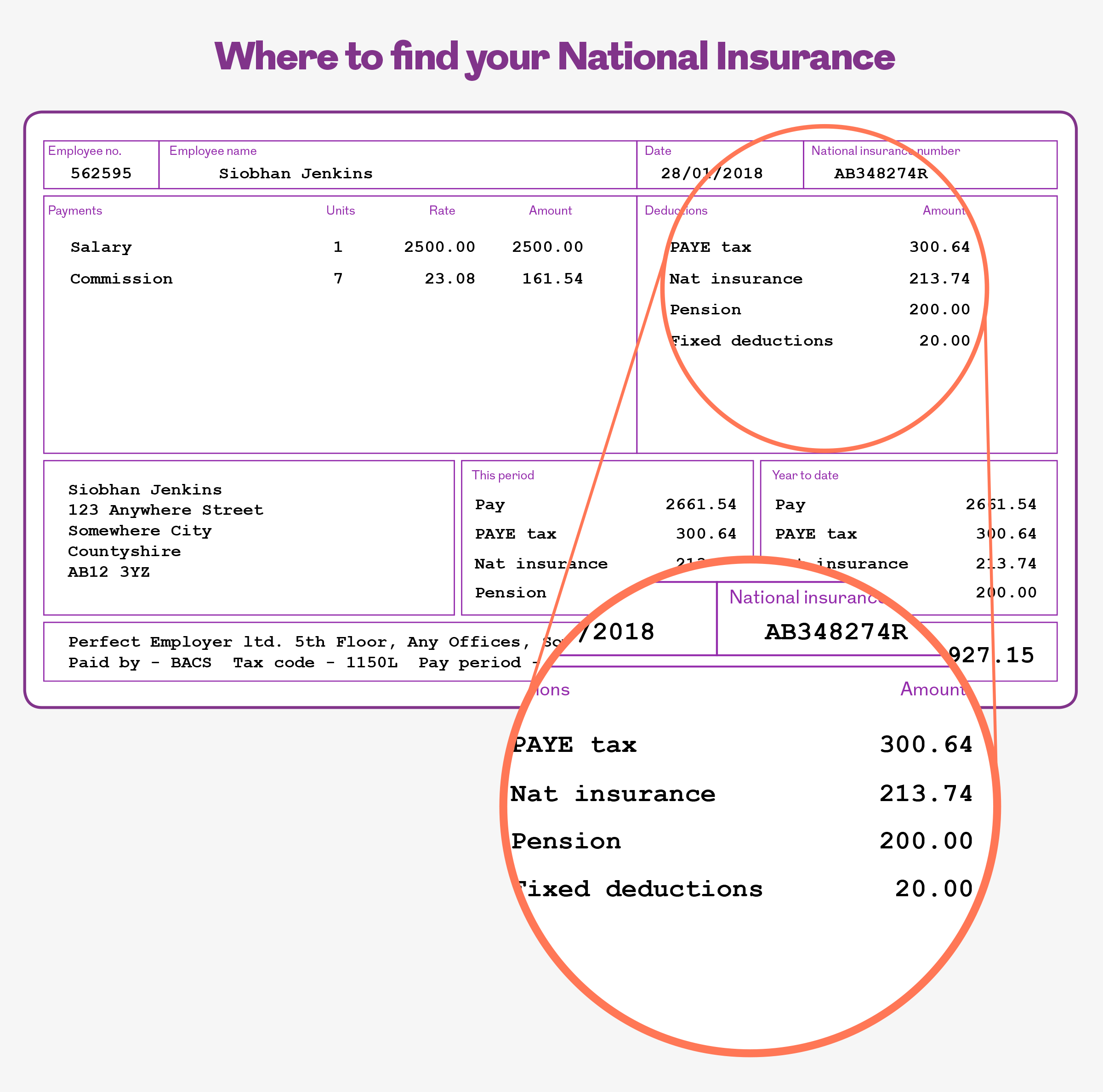

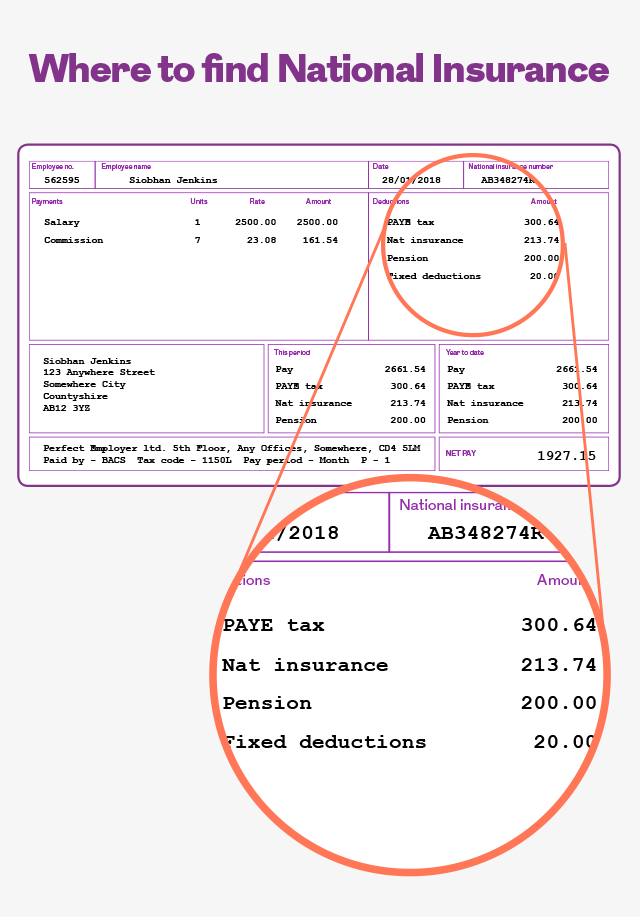

How to read your payslip: National Insurance

When it comes to your payslip, it’s useful to understand the different deductions from your salary, such as National Insurance

There’s lots of different information contained in your payslip, and some of it can be difficult to understand. We’ve already explained how to understand the information on your payslip when it comes to income tax and your tax code, and this time round we’re focusing on another major deduction from your pay: National Insurance Contributions (NICs).

How does National Insurance work?

Everyone who earns above a certain level, known as the ‘Primary Threshold’, has to pay National Insurance. The Primary Threshold for 2018/19 will be £162 per week. Above this level you have to hand over 12% of your pay in NICs, up to an Upper Earnings Limit of £892 per week. Beyond the Upper Earnings Limit, the NICs rate drops to 2% of the rest of your pay.

The good news about paying NICs is that you get something in return. Your right to a National Insurance State Pension when you reach pension age is based on your record of paying NICs. Broadly speaking, anyone who has paid NICs for 35 years at the full rate over the course of their working life can expect to get a full State Pension.

It’s also possible to build up towards the 35-year target without actually paying NICs. Certain groups of people are treated ‘as if’ they had paid NICs through a process known as crediting. Examples of people who would be credited with NICs include:

- Those earning between the Lower Earnings Limit of £116 per week and the Primary Threshold of £162 per week.

- Parents receiving Child Benefit for a child aged under 12.

- Carers, such as those receiving Carers Allowance.

In the past, there were different rates of NICs according to whether you were ‘contracted in’ or ‘contracted out’ of the state earnings-related pension scheme. This also had an impact on how much state pension you received. But, since April 2016, with very limited exceptions, there’s just one main rate of NICs, and all the complexity of contracting out has been removed going forward.

NICs are only imposed on those under State Pension age, so if you’re over this age and still in work, you should make sure that your payslip doesn’t show any deductions for NICs. NICs are charged only on income from earnings and self-employment, but don’t apply to things like pension income or investment income.

Where does your employer come in?

It’s worth being aware that your employer also has to pay NICs on your wages, at a rate of 13.8%. Special rules apply where employers provide benefits like company cars, where you have to pay NICs on the value of the benefit they’re providing.

One important exception to employer NICs is money that your employer pays into your pension. Even though pensions are generally seen as a form of ‘deferred pay’, your employer doesn’t pay NICs on money they put into your pension.

A desire to reduce National Insurance bills has resulted in a rise in something known as ‘salary sacrifice’ or ‘salary exchange’. In normal circumstances, if your employer pays you a pound that you want to put into a pension, they have to pay NICs at 13.8% and you have to pay NICs at 12%. But, if the money goes straight from the employer to the pension scheme, neither the worker nor the firm has to pay any NICs. As a result, employers often do a deal with their workers to reduce their gross pay, but then to make pension contributions on behalf of the worker, instead of the worker doing it themselves. This is a more cost-effective way of getting money into a workplace pension, and is an option offered at growing numbers of workplaces.

Visit gov.uk or the Money Advice Service for more information on National Insurance.

More for you

How to read your payslip: tax codes

Your payslip can be difficult to get your head around, especially when it comes to understanding your tax code

MORE

Year end results 2017

Group Chief Executive Phil Loney explains why 2017 was a record-breaking year for Royal London, and what this means for our members

MORE

Your Q3 2018 outlook

Trevor Greetham, Head of Multi Asset Investments at Royal London, explains how the slowing global economy, alongside rising inflation and interest rates, could impact your money in Q3 2018

MORE