How to read your payslip: tax codes

Your payslip can be difficult to get your head around, especially when it comes to understanding your tax code

For those who get a regular payslip, many of the numbers on it can be a bit of a mystery. We generally just trust that the right amount of income tax, National Insurance and other deductions are being taken off. But what do the different numbers mean, and how can you check if they’re right? This article will focus on income tax, and future articles will cover how National Insurance and pension deductions work.

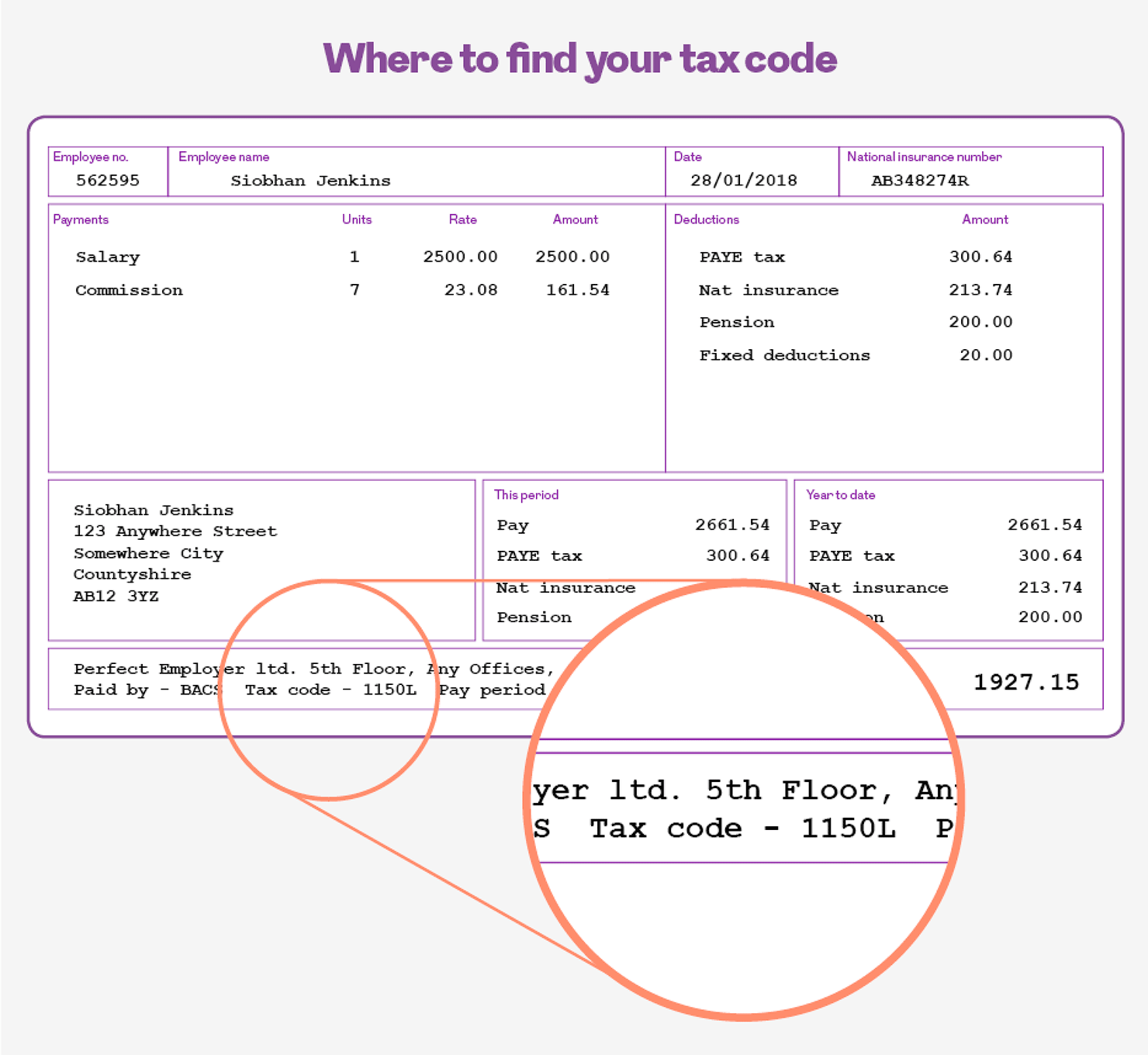

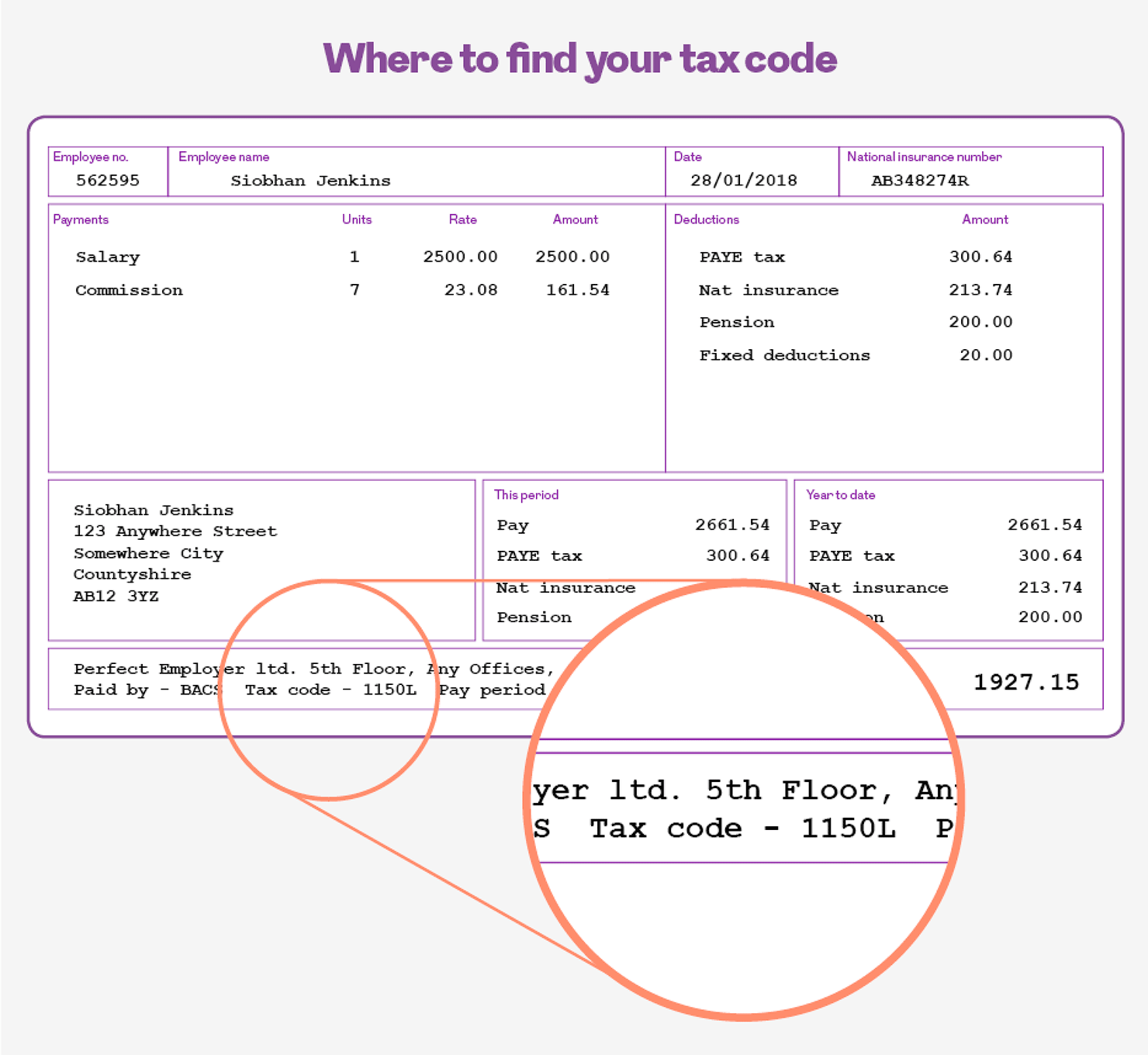

Probably the most mysterious part of your payslip is your ‘tax code’ – the very fact that it is called a code suggests that perhaps you’re not meant to understand it! Royal London’s Good with your Money guide: Decoding your tax code is designed to help you make sense of your tax code, understand what the letters and numbers mean and how you can check if they’re correct.

How does your tax code work?

In simple terms, your tax code tells your employer or pension provider how much of your income they should ignore before they start to apply income tax. In most cases, a higher tax code is a good thing.

Most people have relatively simple tax affairs, with one source of taxable income, such as one job or one pension. They’re allowed to earn £11,500 per year (in 2017/18) before they have to pay tax. HM Revenue and Customs (HMRC) takes this figure, takes off the final digit to give 1150, and sends this as a tax code to your employer. It also adds a final letter to give further instructions to your employer. The most common final letter is ‘L’, which simply tells your employer to apply the standard rate of income tax (currently 20%) to the first £33,500 above the tax-free amount, and then higher and additional rates beyond that. Many people will, therefore, have a tax code of 1150L.

Rates and bands may be different in Scotland, so Scottish taxpayers have an ‘S’ at the start of their tax code to alert their employer to deduct tax at a different rate.

The Decoding your tax code guide also explains the many other different code letters that can appear at the start or end of your tax code. These can arise if, for example, you have claimed the Marriage Allowance, or if no tax at all is payable on a particular source of income.

Things start to get a bit more complex for people who have multiple sources of taxable income, such as two jobs or two pensions. Your annual tax-free allowance of £11,500 applies to your total income for the year, not to each individual job or pension. This means that HMRC has to allocate that total allowance across your different sources of income. As a result, you’re likely to have a different tax code for each source of taxable income.

One potential error can arise when you first start receiving a payment, and HMRC doesn’t have enough information to work out the right tax code for you. Often, you can be on a temporary or ‘emergency’ tax code until there is enough information, and this means you can sometimes be under or over-charged for a considerable period of time.

If you think your tax code is wrong, it’s worth contacting your tax office so that the right amount of tax can be deducted as soon as possible.

More for you

Are you paying too much tax?

Making sure you are on the right tax code will help you to avoid losing too much of your hard-earned money

MORE

Getting the right mix for your pension

Lorna Blyth, Investment Strategy Manager at Royal London, and Trevor Greetham, Head of Multi Asset Investments at Royal London, tell you why a mix of investments is important to help grow your pot and reduce risk

MORE

How can Insight into Work help you?

Whether you’re leaving school, considering a career change, or wanting to return to work after a break, work experience can be a real help

MORE