Is it a good idea to transfer out of your pension?

If you’re considering a transfer out of your pension scheme, it’s important to seek professional advice and make sure you understand the pros and cons

For people in work there are two main sorts of workplace pension arrangements. The traditional sort of pension scheme, often offered by larger firms or in the public sector, pays a guaranteed pension based on how much you earned and how long you worked for the firm.

These are ‘pensions with a promise’, often known as ‘defined benefit’ (DB) pensions.

The other main sort of pension, which is now far more common, is where you build up a pot of money with contributions from the employee and the employer. The money is invested over time and builds up to a pot for your retirement. You can turn this pot of money into an income by buying an annuity, or you can leave it as a pot to be invested, and ‘draw down’ money from the pot when you need it. This arrangement is known as a ‘defined contribution’ (DC) arrangement.

There has been increasing coverage in the media of people transferring their rights under older DB pension arrangements into DC arrangements so that they have more choice about how and when to take their pension. This article will highlight some of the pros and cons of doing this.

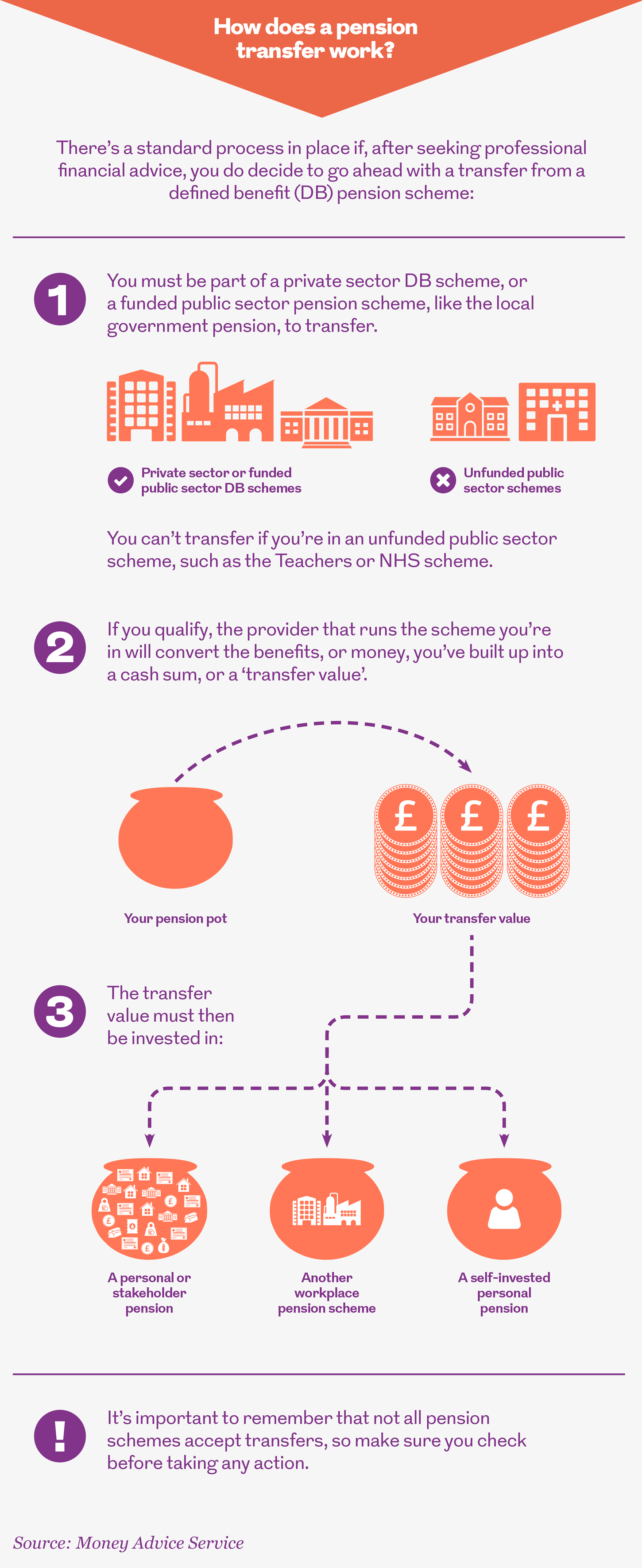

Before going further, it’s worth stressing that, beyond the smallest transfers, it’s a legal requirement to take financial advice before deciding whether or not to transfer. This is because it’s an important and often complex decision with far-reaching consequences for your standard of living in retirement, and it’s important to make a careful and well-informed choice.

Royal London’s Good with your money guide on pension transfers gives a balanced picture when it comes to what you need to know.

What are the disadvantages of a transfer?

The regulators that oversee pensions believe that you should start by assuming that staying in a salary-related DB pension is a good thing to do. There are many advantages to having a DB pension: the value of the pension is guaranteed regardless of the ups and downs of the stock market; it will last as long as you do; it usually provides something for a surviving widow or widower; and it often increases each year to take some account of inflation. These are all valuable features of a pension and should not be given up lightly.

There is some concern with DB pensions around what happens if your employer, or former employer, goes bust, as in recent high-profile cases. But, in this case, there’s a safety net scheme known as the Pension Protection Fund (PPF), which protects a large part of your pension, though doesn’t provide 100% protection. Happily, even though such cases grab the headlines, it’s relatively rare for a scheme to end up in the PPF.

And what are the advantages?

However, some people find that the structure of a DB scheme doesn’t meet their needs. DB pensions are often payable at a set date, such as age 65 (though it may be possible to take a reduced pension earlier than this), and that may not work well for you if you want to retire earlier.

A second attraction of a transfer out relates to what happens when you die. Under a DB scheme, there will usually be a pension for a widow or widower, but if you’re single or divorced this may be of little value. Instead, you may choose to transfer out for a cash lump sum, where any unused amount can be left to your children.

Ensuring your income lasts in retirement

The amounts of money people are often offered for their DB pension rights can be eye-watering. Someone with an annual DB pension of £10,000 per year could easily be offered £300,000 to transfer out. While this looks very large, it’s important to remember that this amount has to last for a retirement that could be 20–30 years, and that when this money is invested it could go down as well as up, whereas the DB pension is guaranteed.

Ultimately, whether or not to transfer is a very individual decision and depends on your own circumstances. Such a decision should only be made after taking – and listening to – impartial and expert financial advice.

More for you

How to prepare your pension for retirement

With new pension freedoms providing a more flexible way of accessing your hard-earned cash, it is important to know what the options are

MORE

Maximising returns and reducing your risk

Lorna Blyth, Investment Strategy Manager at Royal London, and Trevor Greetham, Head of Multi Asset Investments at Royal London, describe how we balance managing risk with growing your returns over time

MORE

Year end results 2017

Group Chief Executive Phil Loney explains why 2017 was a record-breaking year for Royal London, and what this means for our members

MORE