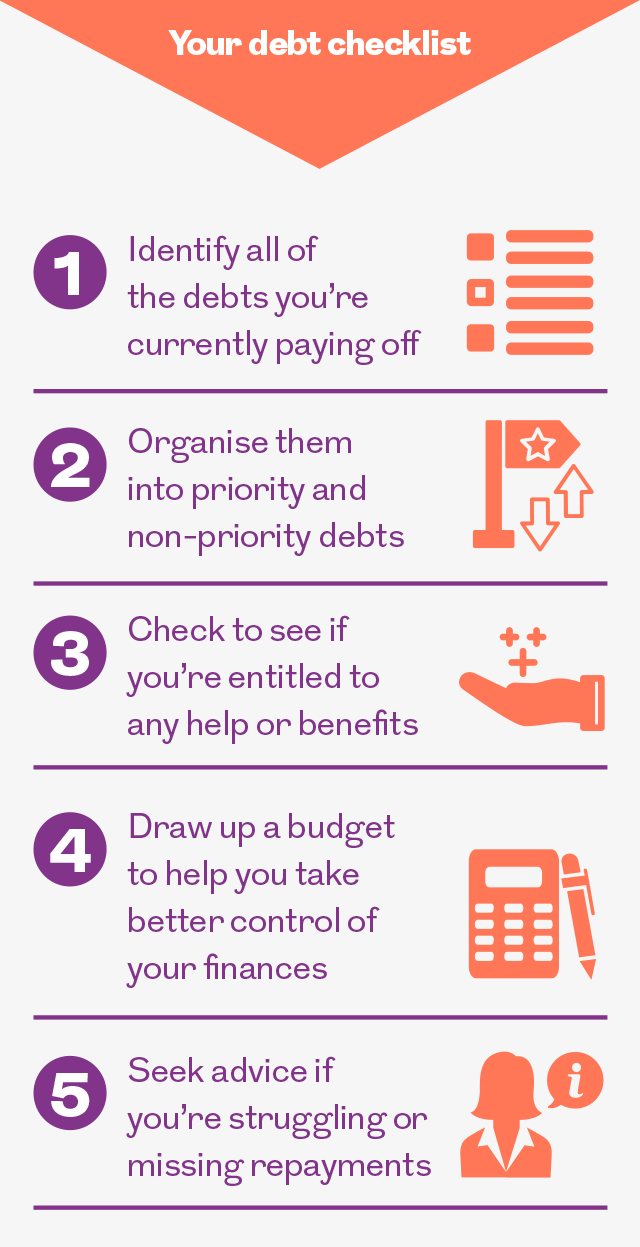

Prioritising your debts

Whether it’s your mortgage or paying off a credit card, debts can make you feel like burying your head in the sand. But prioritising can help you to manage what and how much you owe

Keeping on top of your bills and borrowing can sometimes feel like a full-time job. As well as everyday bills, you may owe money on a credit or store card, be due to make repayments on a loan or mortgage, or owe money to friends.

While it’s tempting to pay off your largest or most expensive bills first, these are not always the most urgent ones.

Debts fall into two categories: priority debts and non-priority debts. It’s important to deal with your priority debts first, as the consequences of not doing so can be serious. For example, if you don’t pay your rent you could lose your home, if you don’t pay your gas bill you could be cut off and if don’t pay your Council Tax you could end up in prison.

Priority debts

These debts include:

- Your rent, mortgage and any loans secured against your home

- Council Tax

- Gas and electricity bills

- Child maintenance

- Your TV licence

- Income Tax, National Insurance and VAT bills

- Court fines

Once you’ve dealt with your priority debts, you should then look at your non-priority bills.

Non-priority debts

These are bills where the consequences of not paying them are less serious than with priority debts. But this doesn’t mean you should ignore them, as the organisations you owe money to could eventually take you to court or send in the bailiffs to collect the money from you.

Non-priority debts include:

- Credit or store cards bills

- Hire purchase debts

- Loans that aren’t secured against your home

- Bank overdrafts

- Payday loans

- Mail order catalogue bills

To make sure you don’t fall behind with these bills, you need to make the minimum payments due on them.

If you then find you have some spare cash, you can use this to pay off more of your most expensive debt – this will be the one that charges the most interest. But remember to check that there are no penalties for making overpayments. Once you’ve cleared this debt, then you can concentrate any overpayments on your next most expensive debt.

The quicker you can pay off these debts, the less interest you’ll end up paying and the sooner you’ll be out of debt.

For more ideas on how to clear credit and store card debts, and reduce the cost of personal loans, visit the Money Advice Service website.

Maximising your income

If you’re on a low income, or have caring responsibilities, you may be entitled to certain state benefits. You can use one of the benefits calculators on the government website to check if you are.

Taking control of your money

Drawing up a budget so that you can see exactly what money you’ve got coming in and going out each month can also help you take control of your finances. You can use a budget planner, budgeting app or simply pen and paper to help you do this. This will also help you identify which bills and debts you can afford to pay and where you might be able to make savings if you’re struggling.

If you find yourself missing repayments, or your debts are getting out of control, there are several free debt advice agencies that can help and won’t judge you. They can also help you negotiate with any organisations you owe money to. These include:

Unlike debt management companies, these organisations do not charge for their services, leaving you with more money to pay off your debts.

It’s important to keep up with your bills as if you fall behind this could affect your credit record and make it hard to borrow money in the future.

More for you

Should you take your debt more seriously?

Borrowing to make purchases can leave you paying the price long after you’ve forgotten what you bought

MORE

Maximising returns and reducing your risk

Lorna Blyth, Investment Strategy Manager at Royal London, and Trevor Greetham, Head of Multi Asset Investments at Royal London, describe how we balance managing risk with growing your returns over time

MORE

Year end results 2017

Group Chief Executive Phil Loney explains why 2017 was a record-breaking year for Royal London, and what this means for our members

MORE