Spending over the festive season: dos and don’ts

Trying not to overspend during the festive season can be very tricky. Take a look at our spending ‘dos and don’ts’ to help you stick to a budget

With big shopping events like Black Friday, Cyber Monday and Christmas, the temptation to spend over the festive season can be too strong to resist. But, for many, this can lead to money struggles and mounting debt. According to National Debtline, more than one third of people in the UK paid for Christmas using overdrafts, credit cards and store cards last year, and millions of people started 2018 with a festive debt hangover.

So, how can you make sure you avoid overspending and start the New Year in good financial shape?

Write a list of who you’re buying for, work out how much you can afford to spend on each person and try and stick to it. Last-minute impulse buys are often the most expensive and least appreciated, so it pays to plan ahead.

Be prepared for shopping events like Black Friday, Cyber Monday and pre-Christmas sales, and don’t be lured by flashy deals that look better than they really are. Sellers have been known to artificially increase the price of products just before these online sales to make their discounts look more generous. If you want to buy particular items, research the best deals on price comparison websites so you can spot real bargains when the sales start.

When it comes to planning Christmas, you can save money if you buy some of the things you need ahead of time. Look out for special offers on non-perishable food items from November onwards, or earlier if the items will last. From chocolates and biscuits to pickles, chutneys and sauces – and even Christmas crackers – a lot of supermarkets run cut-price or buy-one-get-one-free offers that can help you keep costs down.

Search for discount or voucher codes online to find websites offering money-off vouchers for your favourite online stores. Alternatively, you could consider buying through a cash-back website that offers free registration. These websites pay you a percentage of the money you spend when you click through them to a participating retailer’s website.

If you have lots of people coming over for Christmas dinner, consider asking them to bring a course each, or a different contribution, to spread the cost and stress.

Using a credit or debit card to pay for your shopping can protect you if your purchases are faulty or fail to arrive. But try to clear the balance on your credit card as soon as possible to avoid incurring interest charges. Find out more about credit card and debit card protection at the Money Advice Service.

When it comes to gift giving, Secret Santa – where you buy a present for just one person and your identity as gift giver is kept hidden – can save you a lot of money, especially if you’re part of a large extended family. Alternatively, you could agree a maximum amount that everyone spends on presents, buy presents just for children, or give ‘IOU cheques’ with promises of babysitting, dog walking, gardening or cooking, which are free for you to give but worth a fortune to the recipient.

How often have you wished that someone had given you cash instead of buying a present you don’t want? There’s no shame in giving cash as a present, especially to children and young adults who are trying to save up for a big purchase, or even university.

If you’re able to, putting a bit of money aside each month could make meeting the cost of next Christmas a lot less painful.

Christmas means spending time with the people you love. You don’t need to spend a fortune on expensive presents that’ll leave you worrying about money for the next 12 months.

More for you

Helping the organisations that matter to you

Your nominations helped us donate £350,000 to not-for-profit organisations across the UK in 2018

MORE

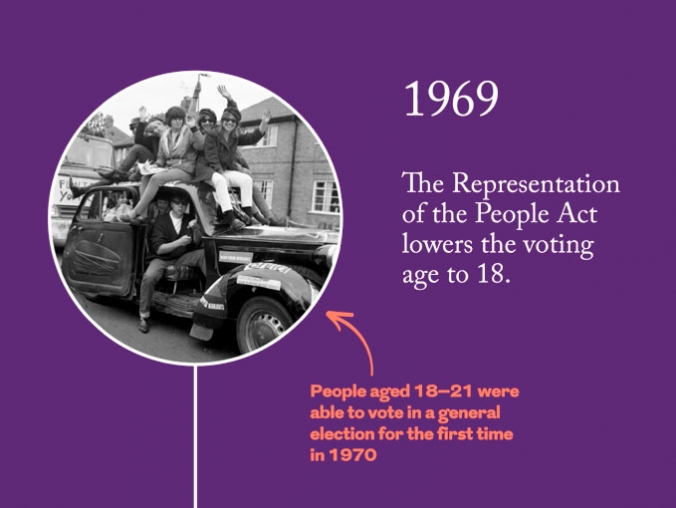

Why is voting so important?

Find out why voting is such an important part of our society and our business, and how voting at the AGM benefits you

MORE

Mothers missing out on millions

Royal London's Steve Webb, Director of Policy, and Becky O'Connor, Personal Finance Specialist, explain how a change in the child benefit system is causing thousands of mothers to end up with a reduced state pension

MORE