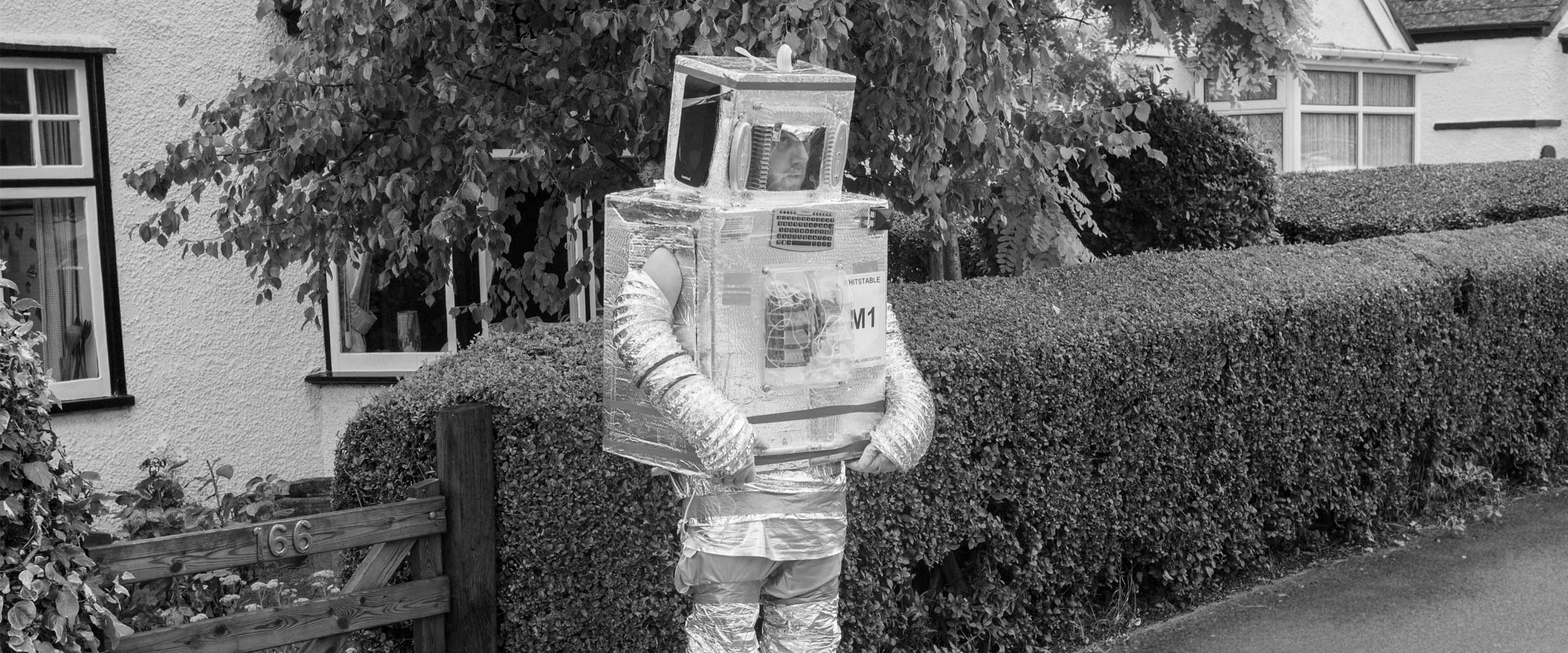

Your mortgage checklist

If you’re thinking about getting a mortgage, there are a number of things that can affect your eligibility aside from a deposit

The Chancellor’s announcement in the 2017 Budget, to raise the stamp duty threshold to £300,000 for first time buyers, brought some measure of relief to young people struggling to raise the money to get on the property ladder.

The change could potentially save first time buyers thousands of pounds, and makes the dream of home ownership more real. However, applying for, and being accepted for, a mortgage is a rigorous process and being prepared will significantly improve your chances of success. These are the key things you need to ask yourself:

1. What’s your credit score like?

Lenders will look carefully at your credit score when assessing whether to lend you money. Things like unpaid credit card bills and county court judgements could spell disaster for your mortgage prospects. Even something as simple as being on the electoral roll will have an effect, so it’s worth finding out what information your lender is likely to obtain about you. Get a copy of your credit report from somewhere like Equifax or Experian, and if your credit score isn’t good then at least you have time to repair it before trying to get a mortgage.

Find out more about improving your credit score here.

2. How much debt do you have?

Mortgage providers want to lend to people who will be able to make their loan repayments, so they don’t want to see people with high balances racked up on credit cards or personal loans. Try to reduce your debts as much as possible before applying for a mortgage, as it will show the lender you can manage your money responsibly.

Find out more about how to reduce your debt here.

3. Are you saving enough?

As house prices have rocketed, so have the size of deposits needed. While saving such an amount may feel out of reach for many first time buyers, it’s worth noting that the more you can save then the better the rates you will be offered by lenders – so every bit helps.

Watch our video to discover ways to boost your savings.

4. Do you have proof of what you earn and what you spend?

When assessing how much to lend you, mortgage providers will want to see evidence of what you earn and what you spend. With this in mind, you’ll need a copy of your most recent P60, as well as six months’ worth of bank statements. As you gather together your bank statements, it’s worth scanning them to see if there are any areas where you can make savings.

5. How much can you pay?

It can be tempting to try and buy the most expensive property you can, but can you really afford it? It’s worth spending time working out what your monthly budget is so you know how much you can comfortably spend on meeting your mortgage payments. Make a list of all your bills, any debt repayments, as well as daily outgoings. Make sure you build in a buffer so you can pay any unexpected bills that may crop up.

Tools like the Money Advice Service’s Mortgage Calculator can help you to work out how much you can afford.

Get expert help

The mortgage market is huge and can be confusing to navigate. Enlisting the help of a mortgage broker or financial adviser can prove helpful, as they can search the market for the best deals and give you help in completing the mortgage application.

More for you

Five ways to save for your first house deposit

Saving for a deposit is one of the biggest obstacles in getting onto the property ladder, but being aware of the many options available may help you to reach the sum you need

MORE

Year end results 2017

Group Chief Executive Phil Loney explains why 2017 was a record-breaking year for Royal London, and what this means for our members

MORE

Your Q3 2018 outlook

Trevor Greetham, Head of Multi Asset Investments at Royal London, explains how the slowing global economy, alongside rising inflation and interest rates, could impact your money in Q3 2018

MORE