Are you entitled to any unclaimed money?

Billions of pounds are lying unclaimed in pensions, policies, accounts, investments and prizes across the UK. Is any of it yours?

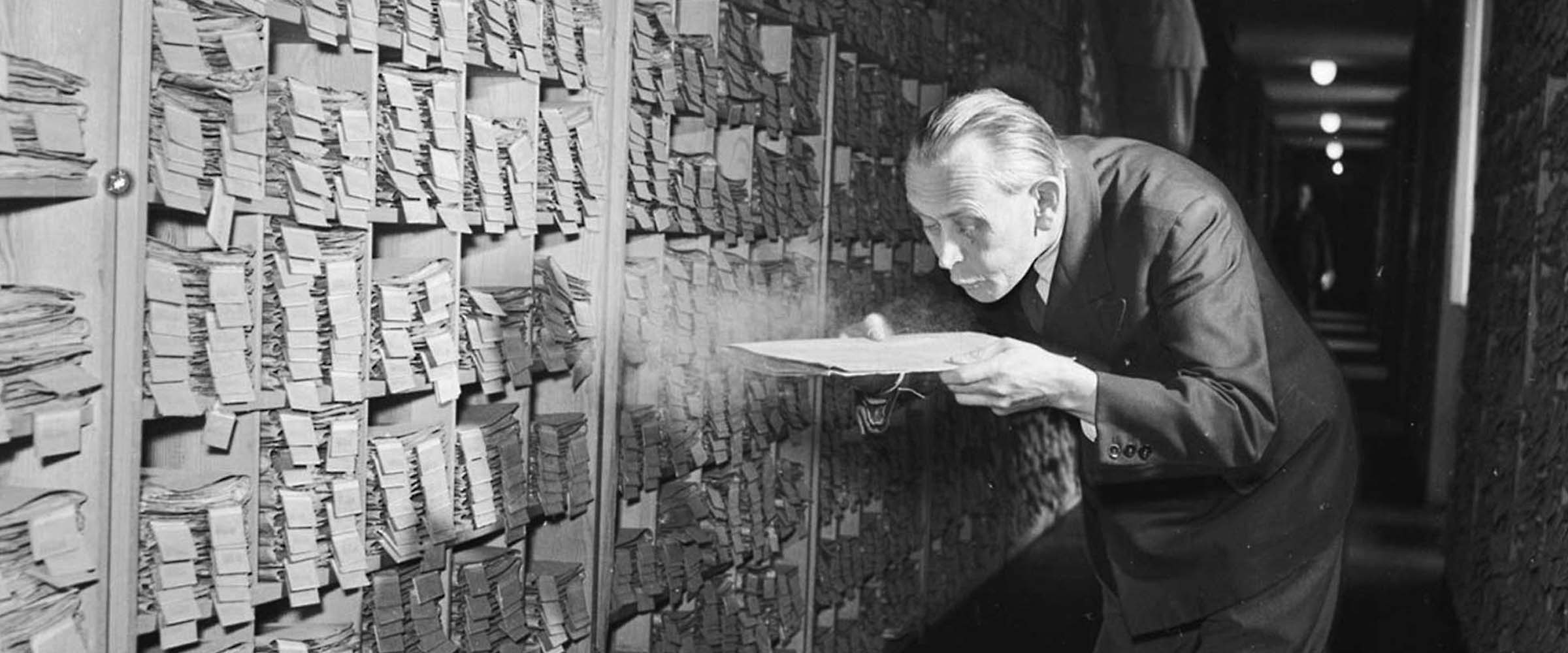

There’s a wonderful statistic that says there is £600m lost down the back of the nation’s sofas. That amounts to £22.23 per household, not a huge sum but certainly worth a rummage. However, there could be a far bigger pot of cash waiting for you. That’s because billions of pounds are lying unclaimed in forgotten pension pots, policies, bank accounts, investments and prizes.

The estimates for the total amount of unclaimed financial assets in the UK range from a conservative £15bn to an eye-popping £77bn, depending on which report you read. That means that every man, woman and child in the UK could have £1,100 sat in a forgotten account. So, how do you find it?

The good news is tracking down lost cash is relatively easy, as there are websites and companies ready and waiting to help. In fact, some companies, including Royal London, go to great lengths to try and find customers who they think have forgotten about their assets.

“Unfortunately, over the lifetime of a policy, which can be for many years, we can lose touch with some customers,” says Jonathan Simm, Senior Communications Manager at Royal London. “This is largely because some will move house and not tell us they have moved.” While people tend to communicate their change of addresses to employers, banks, and gas and electric companies, insurance companies are not always on their priority list.

“When this happens we spend money with a third-party agency to try to find out where our customers have moved to. We will make another attempt to trace someone if we are at a point where we have money to pay out to them. In this situation, soon after the customer has confirmed their new address and we are satisfied we have the correct person, we will send them a maturity payment, which can be many thousands of pounds,” says Jonathan. “Customers are often astonished that we have gone to such lengths to track them down, not because they owe us some money, but so we can make a pay-out.”

“Since April 2015, over 100,000 customers have responded to our letters and we’ve updated their address details on 144,000 policies – we’re then able to provide them with a service through to retirement, or their policy’s maturity date, or pay out the funds that are due. After getting back in contact, customers have requested to exit 15,000 policies, and we’ve paid out £173m – an average of £11,500 per policy,” adds Donald Moffat, Data Integrity Manager at Royal London. “We also sadly identify that some customers are deceased and, where possible, we extend searches to the named informants on death certificates and attempt to pay the claim value to the beneficiaries.”

You don’t have to wait for a company to find you to give you money. It is easy to find out if you have any forgotten savings. Start by seeing if you have any lost bank accounts by filling in your details at www.mylostaccount.org.uk. This is a joint venture with the British Bankers’ Association (now part of UK Finance), the Building Societies Association and National Savings & Investments and will check if you have any lost current accounts or savings accounts. It’s estimated there’s £850m sitting in these accounts, so it is worth taking five minutes to fill out the form.

If you manage to track down any Premium Bonds through the service, the next step is checking whether you have won a prize – there is over £50m lying unclaimed! You can find out if some of this is yours by entering your bond numbers into the prize checker at www.nsandi.com.

Whilst on the hunt for lost prizes you can also check if you have an unclaimed lottery prize. These are only held for six months, but if you have your ticket you can go to www.national-lottery.co.uk to see if you are a winner. There are currently prizes worth as much as £1m waiting to be claimed.

Pension funds, too, can easily go astray – particularly when you change job. The Pension Tracing Service has the details of over 200,000 pension schemes that it will hunt through on your behalf. With over £5bn sitting in lost pensions, a quick hunt could make a meaningful difference to your lifestyle in retirement. The government is also working with businesses across the pensions industry, as well as regulators and technology firms, to implement a Pensions Dashboard service by 2019. The service will allow you to see all of your pension pots together in one online system, making it easier for you to locate the money you’ve saved.

Finally, if you think you might have a forgotten investment fund then the Investment Association and the Association of Investment Companies can help you track down unit trusts and investment trusts.

These are all free services that simply require you to fill out forms, so don’t be tempted to pay a company to search for lost assets on your behalf. It is money you do not need to spend.

More for you

Royal London Foundation: supporting your communities

Thanks to your nominations, we’ve been able to provide funding for not-for-profit organisations across the UK. Here are a few stories of those who received support from us

MORE

Insight into Work: come and work with us!

Our Insight into Work programme means members and their families can experience work at Royal London. Five of our newest candidates tell us about their time working with us

MORE

ProfitShare

We give your savings pot an extra boost by adding a share of our profits to your plan every year

MORE