Giving something back to you

As a mutual, we think our members should share in our success. That’s why, when we do well, we’ll aim to boost your retirement savings. We call this ProfitShare

In 2017, we extended our ProfitShare award to more of our pension customers – sharing a whopping £114m of our profits with more than 950,000 customers and members.

After a very successful 2017, we were delighted to share even more of our profits with qualifying customers in April last year.

How we shared our success

- We shared £142m with our customers and members.

- Over 1.2 million customers will shared in our success.

- We’re boosted the retirement savings of qualifying unit-linked customers by 0.18%.

- We’re boosted the retirement savings of with profits customers by 1.4%.

How ProfitShare works

Your ProfitShare award

You’ll find details of your ProfitShare award by logging into our online service and on your yearly statement.

Remember, even if your ProfitShare award is small today, over time, your awards could be bigger as your retirement savings grow.

Making a difference to your retirement savings

To give you a better idea of the difference ProfitShare could make, let’s look at an example.

Harry’s aged 30, he’s just joined his employer’s pension plan and he’s decided to contribute £200 each month. Harry also wants to retire at age 65.

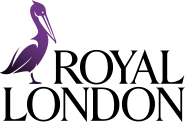

Harry’s projected retirement savings

The retirement savings Harry is able to build up by age 65 depends on how his chosen investments grow each year.

These figures aren’t guaranteed and are just an example. Harry could get more or less than this.

We’ve assumed his regular contributions will increase each year in line with inflation, he’ll contribute until he retires at age 65, and we’ll apply a yearly charge of 0.75% to all his regular contributions.

We’ve also assumed that inflation will reduce the buying power of Harry’s retirement savings by 2.5% each year. We’ve allowed for this by reducing the growth rates to 5.4%, 2.4% and -0.5%. This should give a more realistic view of what Harry could buy with his retirement income if it was payable today.

The annual investment growth rates we’ve used are over and above assumed future inflation of 2.5%. If a rate is less than 0%, then the value of Harry’s plan won’t keep pace with inflation. This will reduce the amount he can buy with his plan.

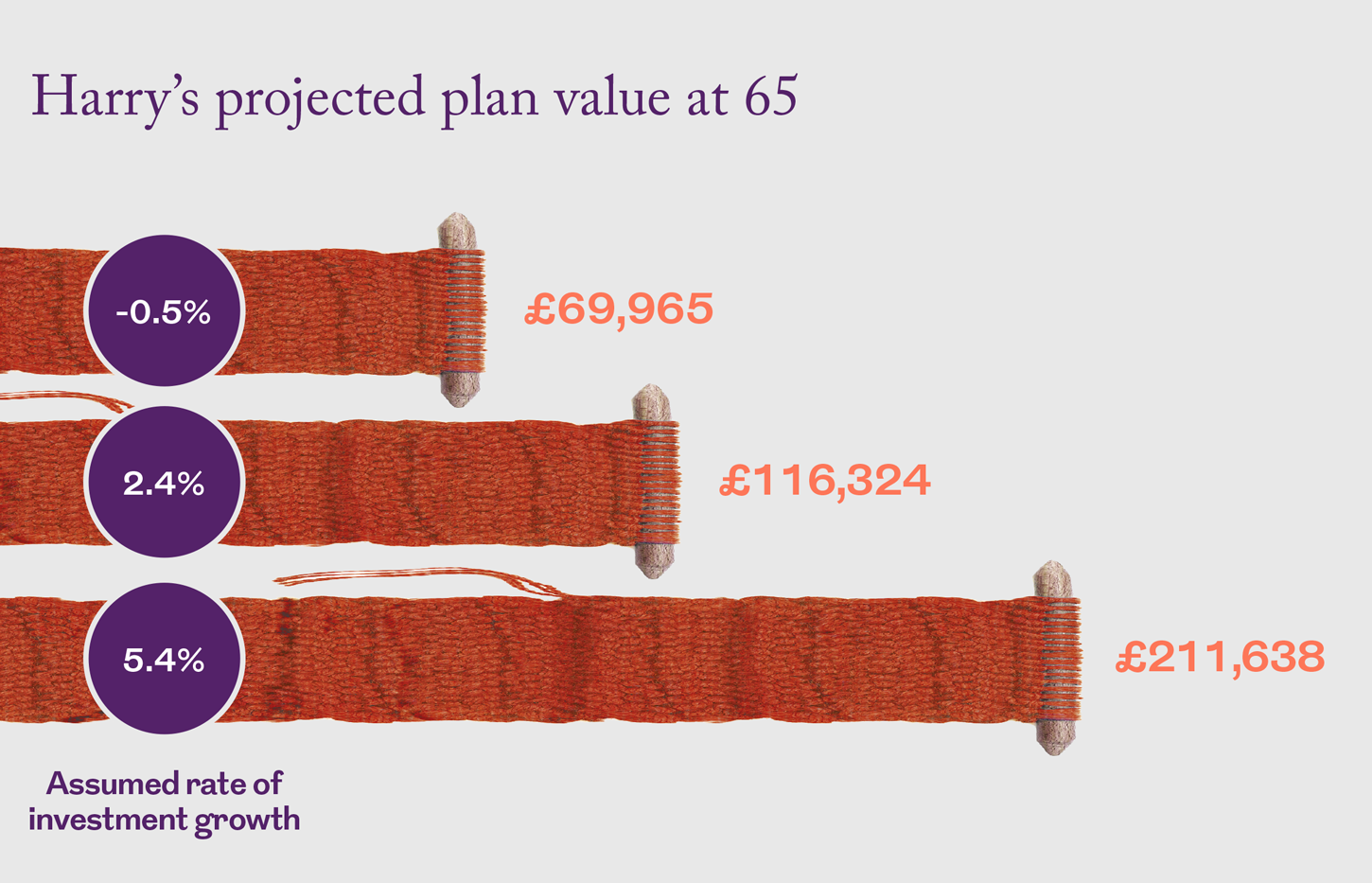

The impact of ProfitShare

Each year, we’ll aim to boost your retirement savings by 0.15–0.25%. Let’s look at the difference ProfitShare could make to Harry’s retirement savings, assuming we award 0.20% of the value of his plan each year and his investments grow at the mid-rate of 2.4% each year.

These figures show that over time, ProfitShare could help to increase Harry’s retirement savings from £116,324 to £120,908. This would give him an extra £4,584.

Remember that Harry is only an example and investment returns are never guaranteed. This means the value of your investment can go down as well as up and you might get back less than what you put in.

More for you

ProfitShare

We give your savings pot an extra boost by adding a share of our profits to your plan every year

MORE

Community matters

The Royal London Foundation helps members support local organisations that make a difference in your communities

MORE

It’s great being a member

From exclusive member benefits to our ProfitShare policy, we make sure you’re looked after

MORE