Investing in stocks and shares

The stock market can be a valuable place to invest your money, but spreading your investments is key to reducing risk and maximising growth

The stock market can look like a very attractive place to put your money at the moment, with most cash savings accounts offering interest rates of under 1%. But how do you go about buying a share, and what happens to your money when you do?

What happens to your money?

If you buy a share in a company then you’ve purchased an interest in that firm. The company can use the money you paid for your share to invest in their firm –perhaps to buy raw materials, pay staff wages or invest in expansion. In return, you hope that your investment helps that company to improve the value of its business so that when you come to sell your share someone will buy it from you for more than you paid for it. Some companies may also pay you an income in the form of dividends (a sum of money, usually paid twice a year) while you hold your shares.

Any increase in the value of your shares when you come to sell them is known as a ‘capital gain’, and any income you earn from your shares is the ‘yield’. If you want an idea of stock market returns, you can take a look at the FTSE 100 – an index made up of the UK’s 100 biggest companies. Over the past five years, the value of the FTSE 100 has increased by 9.8%.

It’s worth remembering that the stock market can be a volatile place, and there’s no guarantee you’ll make money. In fact you could lose what you invest, but over the long term, shares have generally outperformed cash – albeit with a few ups and downs along the way.

How do you invest in shares?

If you want to invest in shares, then you can do so via an online trading platform or a broker. Before you do that, though, it’s important to decide what you’re going to hold your shares in. You could opt for a standard share account, but this means Capital Gains Tax will be charged on any profits, and any dividends you earn will have a tax imposed on them too. Another option is to open an investment ISA, where you can invest up to £20,000 a year and all your growth and income will be tax-free.

When choosing where to open your account, be sure to check the fees that are charged. It’s worth finding a service that meets your needs, but remember that annual management and trading fees can vary considerably from one provider to another.

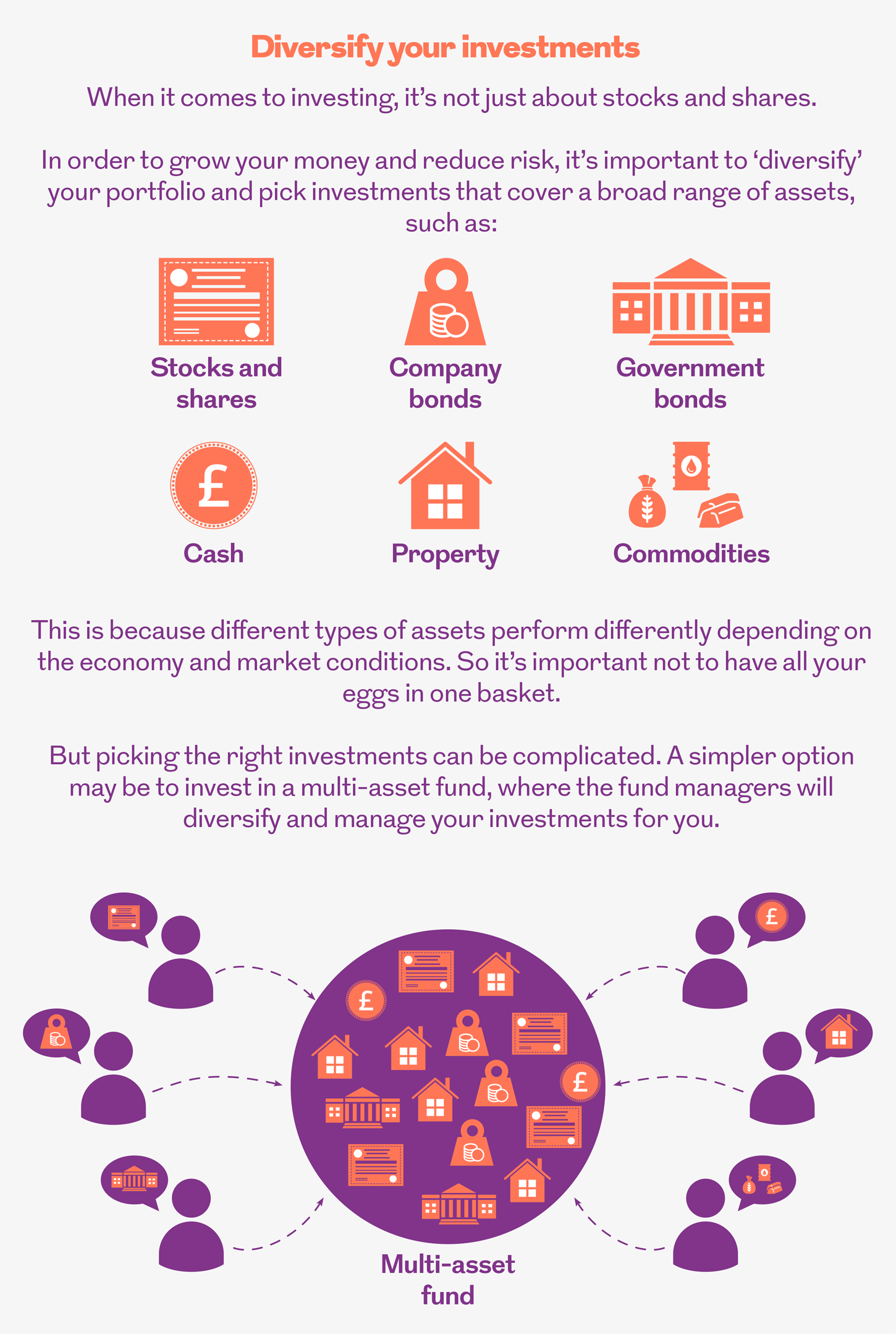

Once you’re all set up with an account, the next step is deciding how you’re going to invest in shares. You could choose to research and buy individual shares, or you can choose to invest in a fund where a manager invests in a range of shares on your behalf. The benefits of a fund are that you get the expertise of a manager and your risk is reduced, as your money is spread across numerous different companies. The only drawback is that there are extra fees charged on funds.

Making sure your investments are balanced

For anyone planning to invest in the stock market for the first time, the hope of making good returns is often matched by a fear of picking the wrong share and losing money. A financial adviser or investment manager can help you decide what to invest in based on what suits your attitude to risk. They can also help you to build a balanced investment portfolio, which is important in order to reduce your risk and give you the best possible long-term returns, particularly if you’re planning to invest a large amount.

For more information about investing visit the Money Advice Service.

More for you

What is a with profits investment?

We explain how investing in traditional with profits products works, and the ways in which it can benefit you

MORE

Year end results 2017

Group Chief Executive Phil Loney explains why 2017 was a record-breaking year for Royal London, and what this means for our members

MORE

What’s going on in the markets?

Piers Hillier, Chief Investment Officer at Royal London, explains how market movements have affected Royal London Asset Management's performance over the past year, and why it's been a good one for members' investments

MORE