Is the pension gender gap affecting you?

A lot has been made of the gender pay gap recently, but what’s not so well known is how this can affect women in retirement

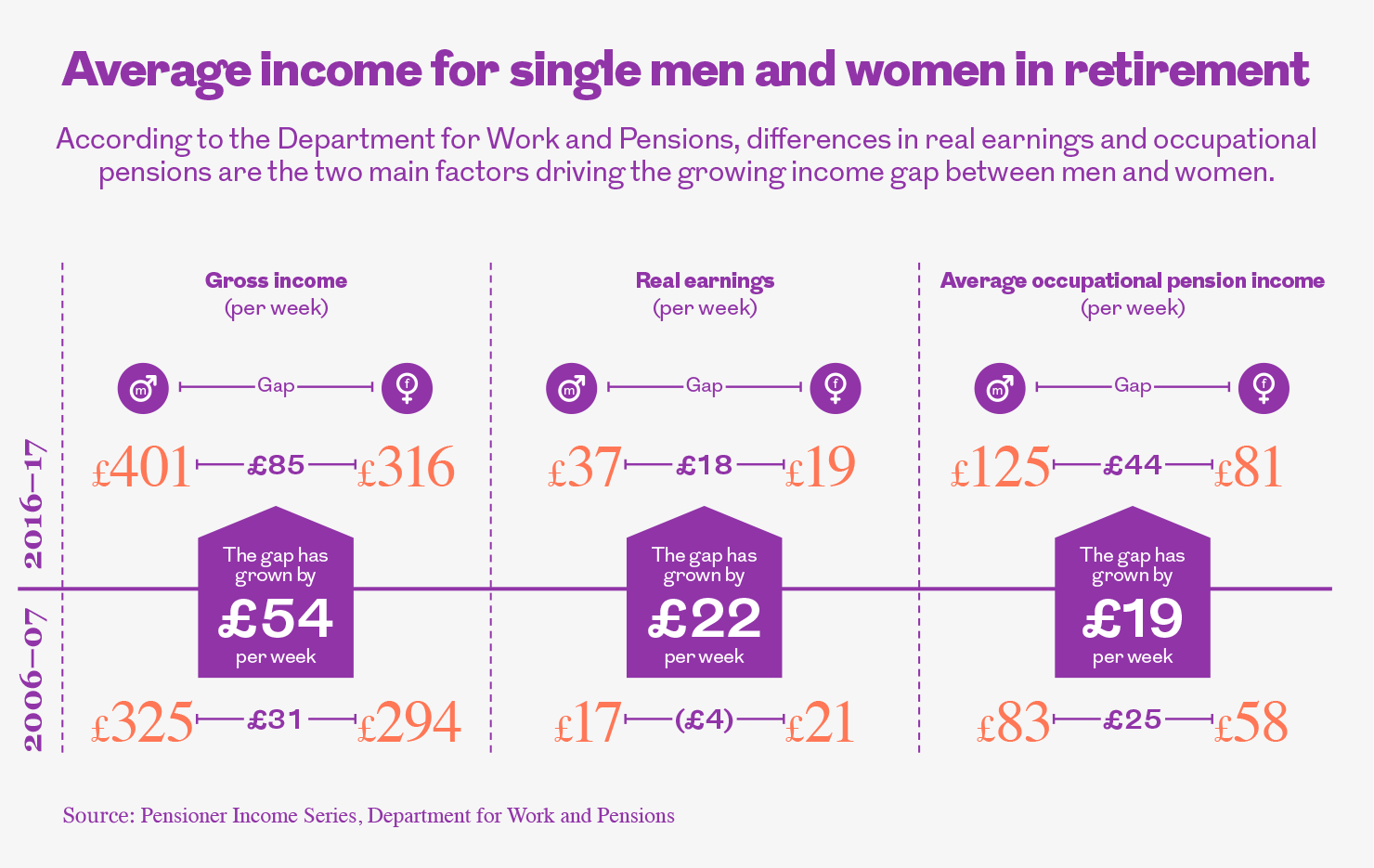

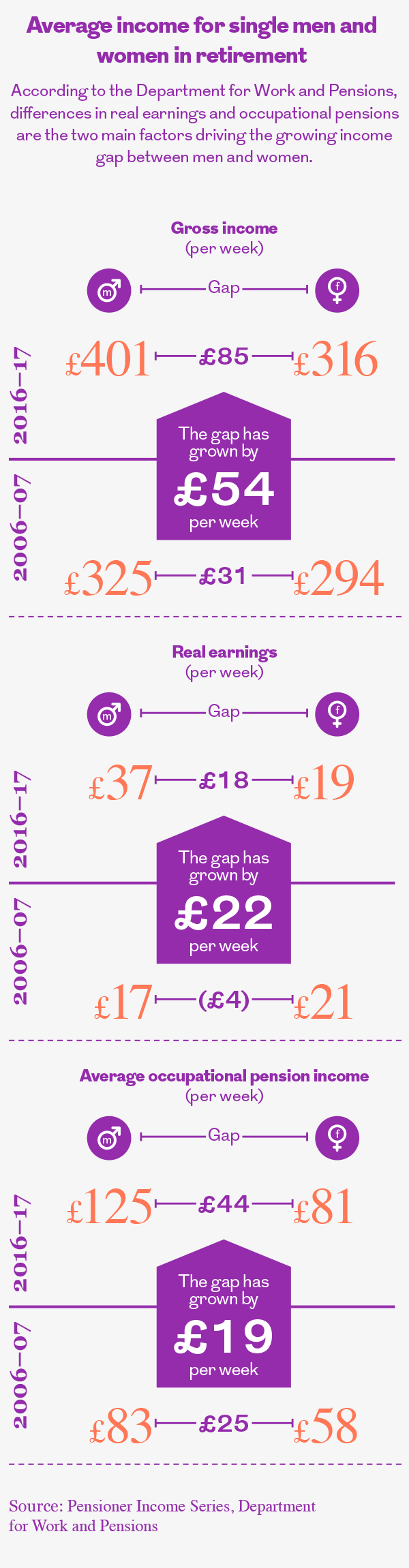

The most recent Pensioner Income Series statistics from the Department for Work and Pensions show that the gap between men and women’s retirement income is continuing to grow.

According to the figures, in 2006/07 the average retired single woman had a gross income of £294 per week, while her male counterpart had £325 – a difference of £31 per week. However, by 2016/17, the gap had nearly tripled to £85, with the average single woman now on £316 per week, and the average man on £401 per week.

Why is this happening?

There are several reasons why this is happening. For a start, women are more likely to be in part-time employment than men, so they’re saving less into a pension. In addition, they also tend to take more career breaks than men, to look after children and family members for example, which will impact how much they’re able to save. Taking time out of the workplace also means women are less likely to build up the 35 qualifying years of National Insurance Contributions (NICs) needed to qualify for a full State Pension.

What can be done about it?

While the growing gender retirement income gap is concerning, there are things that can be done to address it. Probably the best known is auto-enrolment, which began in 2012. This made it a legal requirement for employers to automatically enrol eligible members of staff into a workplace pension scheme. So far the initiative has been a success, with around 10 million people having been enrolled into a scheme and saving for their future.

Over time this will help more women to build up retirement savings, but it’s worth noting that current minimum contribution rates are 5%. This is made up of 3% from the employee and 2% from the employer. This will rise to 8% next year.

However, while saving at this level is a good start, it’s not enough to generate a decent level of income in retirement – so if you can afford it, you should think about saving more.

The State Pension

As it currently stands, the full State Pension is worth around £8,500 per year and is a valuable building block towards a sustainable retirement income. However, to qualify for the full State Pension, you need to have built up 35 years of NICs or credits – this can be difficult if you’ve taken significant time out of work.

However, what’s not so well known is that as long as you’re registered to receive child benefit and have a child under the age of 12, then parents who’ve spent time out of the workforce caring for children can still claim NI credits for that time. You can find more information here.

It’s worth noting that if you’ve spent time out of the workforce as a carer, or you’re looking after a grandchild, then there are also processes by which you can claim NI credits.

If after this you still haven’t built up the necessary 35 years needed to qualify for a full State Pension, then you can buy NI credits to top up your record. Each year of voluntary NI credits will cost you around £760, but in turn this will give you around £240 extra State Pension for every year.

Royal London’s guide on topping up your State Pension offers more information about this.

Another important way for women to support pension savings is to continue to contribute to a workplace pension while on maternity leave. If you qualify for Statutory Maternity Pay and continue to pay into a workplace pension then you continue to benefit from your employer’s contribution, as well as gain NICs. However, maternity arrangements vary between employers so it’s worth checking in advance.

It’s clear that there are still significant challenges when it comes to tackling the gender retirement gap. However, as auto-enrolment progresses, we should see more women saving into a pension and, if they can be encouraged to increase their contributions, things will start to improve.

More for you

Where does your tax go?

We all know we have to pay taxes, but do you know how they’re spent? Test your knowledge with our tax challenge

MORE

Are you missing out on help with your pension?

Working families are losing millions each year by not realising the connection between claiming child benefit and protecting their state pension record

MORE

Pension tax relief: how to get £35,000 of free money

Saving into a pension, and taking advantage of tax relief, can be extremely rewarding

MORE