What is an annuity and do you need one?

If you’re thinking about buying an annuity to provide you with income in your retirement, it’s important to know the basics

What is an annuity?

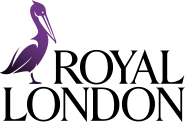

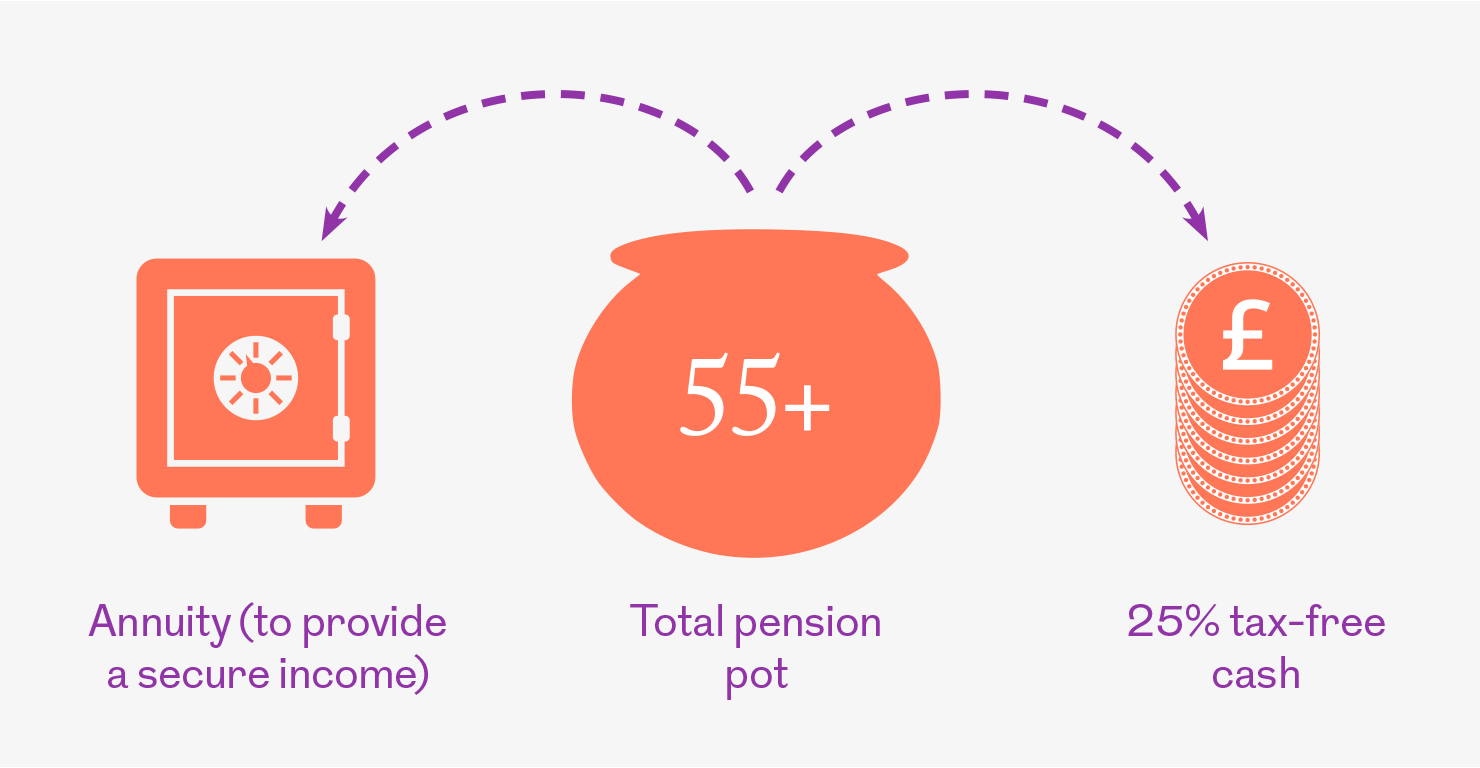

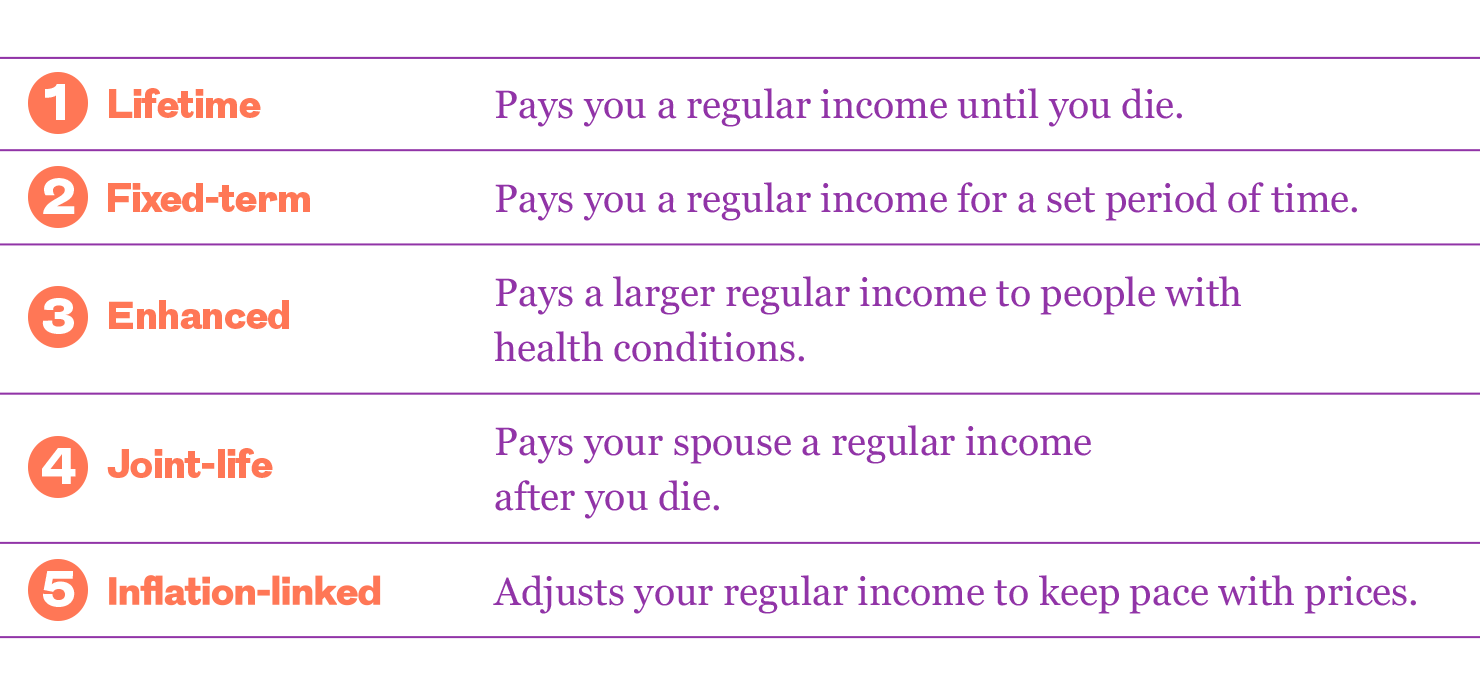

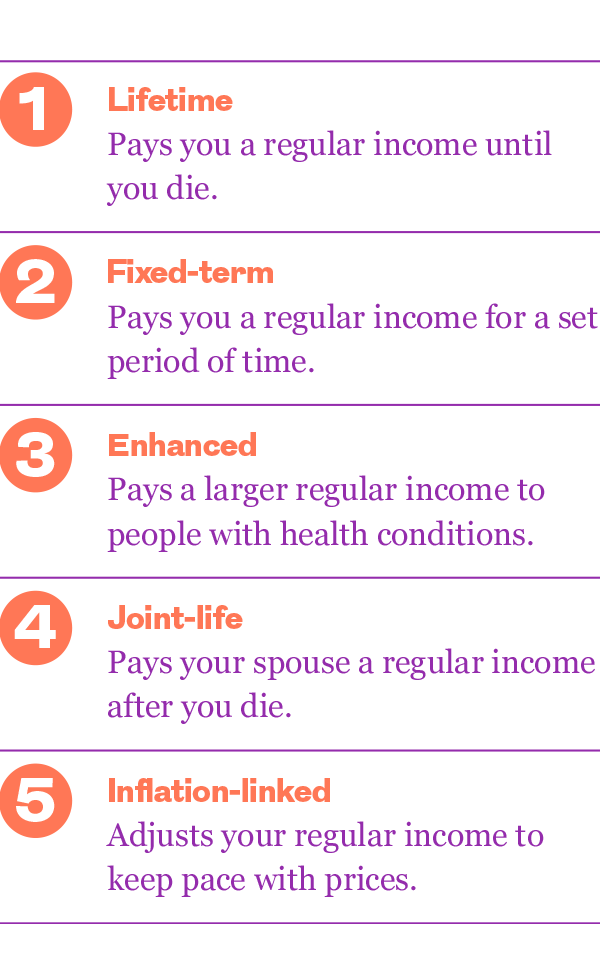

When people choose to take an income from their pension, they’ll often take their 25% tax-free cash and then use the rest of the money to purchase an annuity. This is known as a ‘secure income’. These products pay out an income either for the rest of your life (lifetime annuity), or for a set period of time (fixed-term annuity). These products are valuable, as people can rely on receiving a particular level of income.

However, it’s important to know that once you purchase an annuity then you can’t change your mind, which could prove difficult if your circumstances change.

How is the income on an annuity calculated?

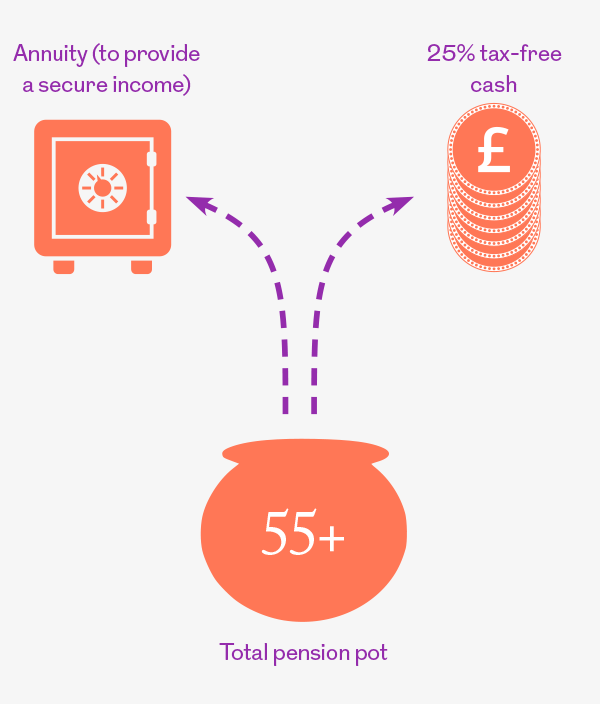

There are a number of factors used to work out annuity incomes:

- Interest rates: interest rates are a key factor in determining the rates providers can offer. Unfortunately, interest rates have been low for many years, which means the incomes annuity providers have been offering have also been low.

- Life expectancy: as people live longer, they’ll need their secure income to last longer. This means the amount of income you receive every month will be lower. However, the later you leave it before purchasing an annuity, the more income you could get.

- Health status: you may be offered a higher level of income if you have any health issues or habits, like smoking, which could shorten your life expectancy.

Aren’t they poor value for money?

The fact that annuities are paying out less income than in the past has attracted bad press. Providers have also been criticised for not telling customers they can shop around with different providers to get the best annuity for them. You can also choose when to purchase the annuity, as well as what type of annuity best suits your needs.

Customers with small pension pots were also highlighted as a group who received poor value, as they’d only receive a very small income from an annuity. However, the introduction of pension freedoms has really helped these people by allowing them to take their pension as a cash lump sum, rather than making them purchase an annuity.

What other factors do you need to think about?

Annuities have earned a reputation for being inflexible, but there are different types of annuities to suit your needs. In addition to fixed-term and enhanced annuities, you can also get joint-life annuities, which allow your spouse to carry on getting an income after you die. You can also get inflation-linked annuities, which adjust your income on an ongoing basis to keep pace with prices.

It’s important to think through what you need from your annuity before you go out to the market.

How do I get the best deal?

Tell your pension provider when you plan to access your retirement savings. They should then let you know how much retirement savings you have and provide you with a quote for purchasing an annuity with them.

However, it’s important not to just accept the first quote given to you. If you have more than one pension pot it might be worth consolidating them, as you may get a larger income from one larger pot than from several smaller ones.

Shopping around for an annuity is known as exercising your ‘Open Market Option’ and it’s extremely important. There are a number of annuity comparison tools out there, such as the one offered by the Money Advice Service. Royal London also offers an annuity bureau tool that lets you obtain quotes from a range of annuity providers. However, if you do need further support, consider speaking to a regulated financial adviser.

More for you

Where does your tax go?

We all know we have to pay taxes, but do you know how they’re spent? Test your knowledge with our tax challenge

MORE

How to prepare your pension for retirement

With new pension freedoms providing a more flexible way of accessing your hard-earned cash, it is important to know what the options are

MORE

Your Q3 2018 outlook

Trevor Greetham, Head of Multi Asset Investments at Royal London, explains how the slowing global economy, alongside rising inflation and interest rates, could impact your money in Q3 2018

MORE