Are you thinking about retirement early enough?

Having a plan for your retirement as early as possible can make things much easier for you further down the line

When you first start saving into a pension, retirement can seem a long way away and it’s easy to put off making important decisions. However, thinking about your retirement planning early on can make a huge difference.

Research from Royal London shows that someone aiming for a pension pot of £300,000 would need to save £430 per month if they were to start saving into a pension at the age of 25. This would grow to £630 per month if you put it off until the age of 35. If you were to wait until you were 45 before starting saving into a pension, then you’d need to put away £1,050 per month if you wanted to save £300,000 by the age of 65. It clearly pays to start early.

Planning what’s right for you

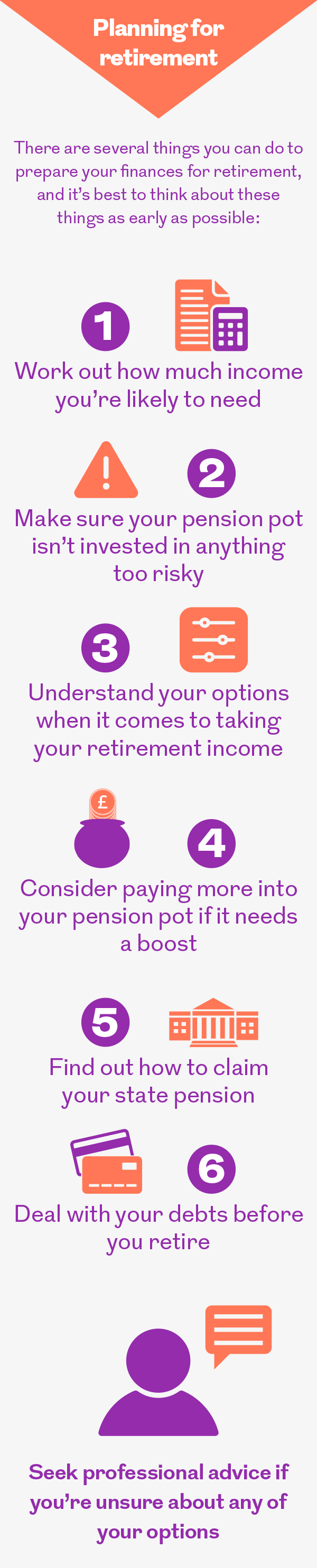

Engaging with retirement planning early on allows you to see if you’re on track to meet your goals, and make changes to your investments or contributions if necessary.

For instance, when you first start saving for retirement, your pension pot is likely to be largely invested in equities, as these have the potential to generate a good level of returns. However, these types of assets can also be very volatile and move up and down in value quickly. This isn’t such a problem when you’re young, as you have time to recover from any market downturns, but as you get closer to retirement you’ll need to work with your financial adviser to look at your investments and make sure your money isn’t invested in anything too risky.

The pension freedoms introduced in 2015 have also given retirees much more freedom in how they take their retirement income. They can opt for the secure income of an annuity, the flexibility of income drawdown or the freedom of a cash lump sum (or a mixture of all three). By starting retirement conversations early, you can understand more about what you need from your retirement income and put plans in place to ensure you choose the right product at the right time.

Things can change

Over the course of your working life your circumstances can change massively and you need to plan accordingly. You may have planned to retire at 65, for instance, but then find that ill health means you have to stop work early or cut your hours. Alternatively, you might decide you aren’t ready to finish working at 65. Thinking about your retirement planning early on means you can deal with these things more easily.

Having a financial adviser is beneficial because you can have an ongoing conversation with them about your plans for retirement over the course of several years. Pension providers are also recognising the importance of engaging with people early.

Earlier this year, Royal London announced that it would start sending out communications known as ‘Wake Up’ packs five years before their customers’ expected retirement dates, which include information about the different options they have when it comes to their pensions. These are followed up with further packs issued two years before the expected retirement date, and then a final one six months beforehand.

Under current rules providers only need to start sending out these packs six months before the expected retirement date. However, this leaves the customer with very little time to make informed decisions or make changes to their plans. Communicating with people earlier on will really make a difference to the outcomes they get in retirement.

More for you

Where does your tax go?

We all know we have to pay taxes, but do you know how they’re spent? Test your knowledge with our tax challenge

MORE

How can risk affect your retirement?

Investing your money can be risky. But, it’s important to take some risk if you want your pot to grow and enjoy a comfortable retirement

MORE

Is flexible retirement right for me?

On the surface flexible retirement may seem like an attractive option for many, but it is important to weigh up the practicalities

MORE