Five reasons to stay in your workplace pension

There are a number of important benefits you could lose if you choose to opt out of your workplace pension scheme

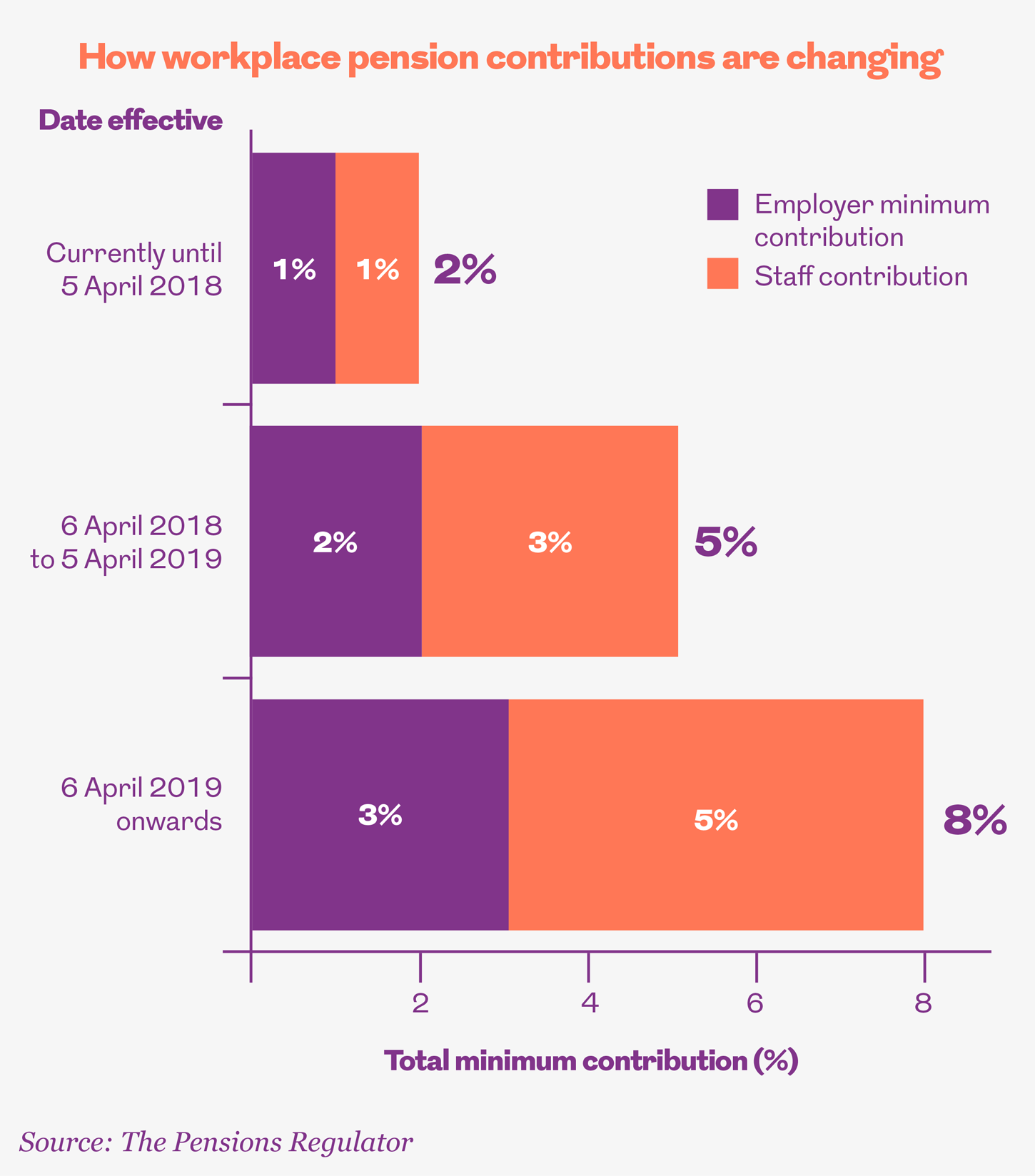

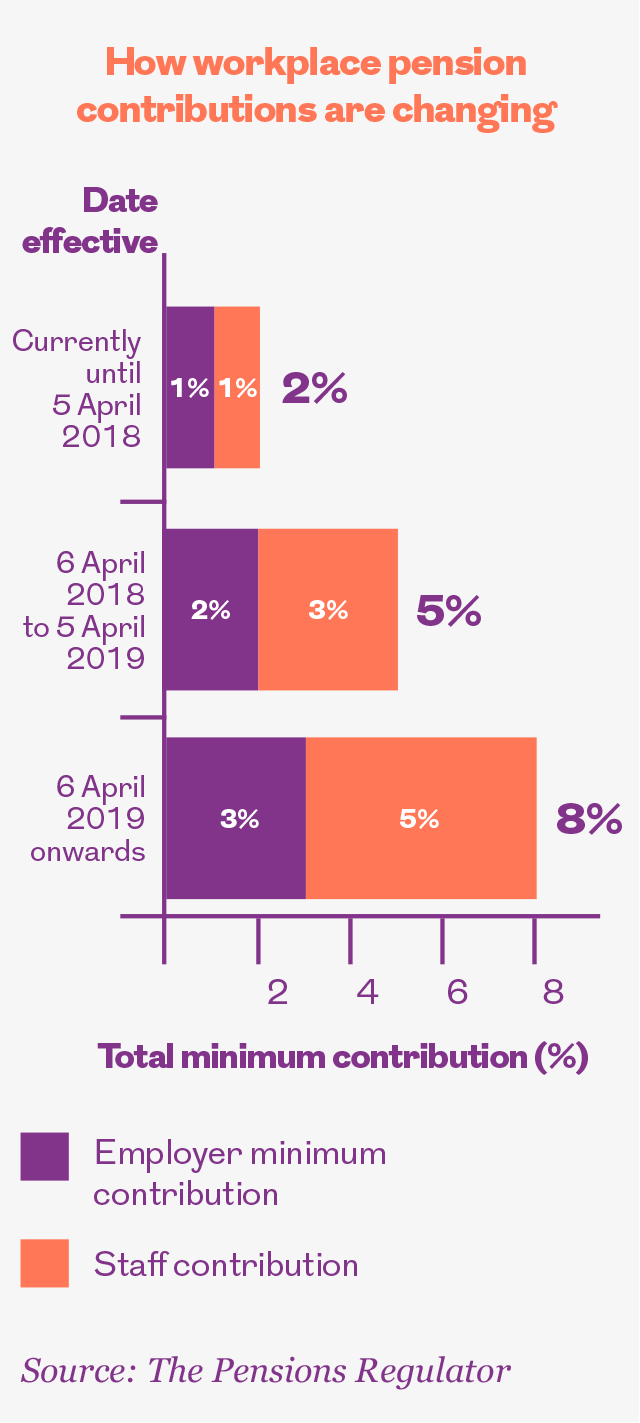

In April 2018 (and again in April 2019) the minimum amount that people have to contribute into their workplace pension increased. While it’s widely expected that most people will choose to stay in the pension scheme, there’s always the freedom to opt out. So why should you stay in your workplace pension?

1. Your boss pays in too

Pensions are a form of deferred pay, especially when it comes to the money your employer pays in. Not only does your firm pay you a wage, they put money into a pension so that you have income in retirement.

The amount they put in varies. There’s a minimum amount they’re required to contribute by law, but many employers go further than this, particularly if you also increase your contribution. If you opt out of the workplace pension, it’s like turning down free money, because your employer will stop paying in as well.

2. You get help from the government through tax relief

When you earn money you pay income tax, usually at a standard rate of 20%, but at 40% or 45% if you are a higher earner. When you choose to put some of that money into a pension scheme, you no longer have to pay tax on it. What this means in practice is that, if you want to put £1 into a pension, it’ll only cost you 80p if you pay tax at the standard rate – the government puts in the other 20p.

For most high earners, the advantages could be even greater.* For someone paying tax at 40%, it only costs them 60p, because the government contributes the other 40p. A combination of tax relief and a scheme where an employer matches what you put in means you could get £2 in a pension (one from you and one from your employer) at a cost to you of just 80p. There aren’t many investments that can match that.

3. You get access to a tax-free lump sum

Later in life, when you’re thinking about taking money out of your pension, you can usually take a quarter of the whole pot tax free. This means that you pay no tax on your contributions, get tax breaks on the growth of the money inside your pension, and then can take out a good chunk with no tax at the end. Again, there aren’t many investments that have a tax treatment as advantageous as this.

4. Your pension scheme may pay out to your loved ones if you die

The main aim of a pension scheme is to provide you with something to live on when you’re retired. But many pension schemes will have additional benefits if you were to die or be seriously ill.

Some salary-related pension schemes will offer you something called ‘ill health early retirement’, where you can draw a pension before normal pension age if you can’t work, and most pension schemes offer some form of payout if you were to die. This can sometimes be a multiple of your annual salary, and can be very valuable to loved ones you leave behind.

5. You’ll have more choice over when to retire

Ultimately, the purpose of pensions is to replace your wage when you’re ready to stop work. The more you have in pension rights, the more choice you have about when you can afford to retire. There would be nothing worse than deciding you’re ready to stop work but realising you have to carry on – possibly for years – because you haven’t built up enough to live on.

Although it’s always tempting to boost your income today, it comes at a cost. Opting out now and giving up on the money your employer puts in will greatly reduce your pension at retirement and could mean that you’re still going into work long after the point when you’re ready to stop.

You can find more information about workplace pension schemes at The Pensions Advisory Service, and the benefits of automatic enrolment at the Money Advice Service.

*People with a taxable income of more than £150,000 should seek further independent advice regarding their tax position in relation to their workplace pension.

More for you

Pensions made easy

Pensions can be difficult to get your head around, but knowing the options can help you build the best nest egg possible for your retirement

MORE

Simple steps to saving for a pension

Following our simple rule of thumb can help make saving for a pension from an early age much less intimidating

MORE

Year end results 2017

Group Chief Executive Phil Loney explains why 2017 was a record-breaking year for Royal London, and what this means for our members

MORE