What does the Budget mean for you?

The Chancellor of the Exchequer presented his Autumn Budget to Parliament on 22 November 2017. Our Director of Policy Steve Webb explains five key things that you should takeaway

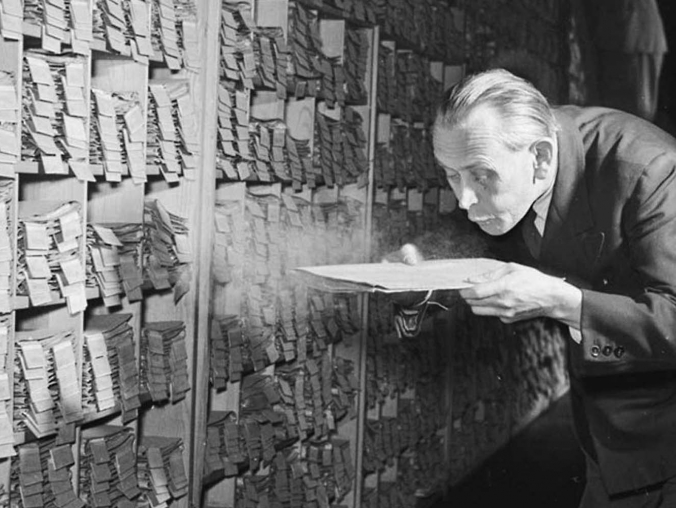

The Budget is always a blizzard of announcements, and 2017’s was no exception. Royal London experts pored over the small print to find the five main things you need to know:

1. April 2018 saw a worthwhile boost for the lowest earners

For people on a low wage, April 2018 brought a welcome increase in the national living wage. The minimum hourly rate for those aged 25 or over rose by 4.4% from £7.50 to £7.83. In addition, the amount you can earn without paying tax will rise from £11,500 to £11,850 in 2018/19, though this increase simply keeps pace with inflation. Those dependent on the new Universal Credit benefit no longer have to wait seven days before their entitlement to the benefit begins, and those who would struggle to wait a month or more for their first payment will now find it easier to get an advance payment.

2. First-time buyers will find it slightly easier to buy a house

One of the many costs associated with buying a house is ‘stamp duty land tax’. At the moment this is charged on property purchases worth over £125,000, with higher rates applying if your property purchase is over £250,000, and higher rates still for more expensive properties. The Chancellor announced two changes designed to help first-time buyers in England, Wales and Northern Ireland:

- Any first-time buyer looking to purchase a property worth under £300,000 will pay no stamp duty.

- First-time buyers looking at properties worth between £300,000 and £500,000, will pay no stamp duty on the first £300,000. This will help to remove one of the many barriers to younger people being able to afford to buy a first home.

3. Drivers and those who like a tipple will gain, but smokers will lose

Every year the Chancellor has to decide what to do with taxes on things like petrol, alcohol and tobacco. With inflation running at 3%, he would need to increase these duties by 3% simply to ‘stand still’ in terms of the public finances. This time he was relatively generous, freezing duty on petrol, beer, wine and spirits. The main losers are smokers, who will see the duty on cigarettes increase by 2% over and above inflation.

4. The economic outlook is gloomy

The Chancellor has to forecast how fast the economy will grow in each of the coming years, and the figures he published in the Autumn Budget were much more gloomy than those he published in March 2017. It is now expected that the economy will grow by less than 2% per year for each of the next five years, which is a much slower rate of growth than we have been used to. If he is right, this is likely to lead to less tax revenue coming in and less money to spend on improving public services, such as schools and hospitals. But small business will be relieved that plans to cut the threshold at which firms have to register VAT have been shelved.

5. We can expect to see more taxes to protect the environment

The Chancellor announced a new increased rate of vehicle excise duty for those who buy a diesel car after April 2018, and increased taxation on those who have company cars that run on diesel. He also plans to bring in a new tax to reduce the use of plastic, for example, in ‘single-use’ containers, but nothing will change very soon – the Chancellor simply announced a ‘call for evidence’ on the idea to take place in 2018.

You can access the Autumn Budget in full here.

More for you

ProfitShare

We give your savings pot an extra boost by adding a share of our profits to your plan every year

MORE

Insight into Work: come and work with us!

Our Insight into Work programme means members and their families can experience work at Royal London. Five of our newest candidates tell us about their time working with us

MORE

Royal London Foundation: supporting your communities

Thanks to your nominations, we’ve been able to provide funding for not-for-profit organisations across the UK. Here are a few stories of those who received support from us

MORE